Chapter 6- Spousal Issues

Spousal Issues

INTRODUCTION

| If you want to: | |

| Understand the rules and how to request injured spouse relief. | |

| Understand the requirements to request relief from joint and several liability and how to request innocent spouse relief or to contest a jointly filed return election. |

Key Highlights:

- Two types of spousal relief: injured spouse and innocent spouse. Injured spouse is more common and involves a spouse obtaining his/her share of their refund if the refund was used to pay the spouse’s prior debt. Innocent spouse involves relief from joint and several liability from an understatement or underpayment from a jointly filed return.

- Injured spouse is simple to request: hundreds of thousands of injured spouse claims are filed each year. The taxpayer can file the request with the return or after the return is filed and accepted. The IRS normally will process and send the refund check within 14 weeks.

- Innocent spouse relief is rare, complicated, and often subjective: there are three types of innocent spouse relief as well as relief for separate filers in community property states. There is not a bright line test to qualify for innocent spouse relief and the rules are often difficult to understand and utilize. As such, the IRS received 20,495 requests in 2022 and only 9,721 (47%) were allowed or partially allowed. The low success rate can be attributed to confusing rules and subjectivity in applying the complex requirements.

- Invalid joint return election: spouses can invalidate a joint return election if they did not sign the return or intend to file jointly with their spouse. In these situations, taxpayers must prove their return signature was forged and that they did not give tacit consent to file a joint return.

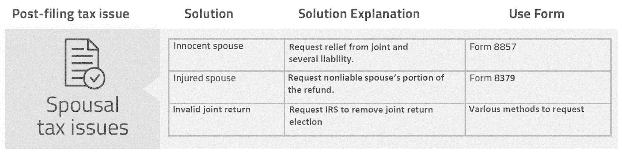

Spousal Issues Solution Grid

What’s New for 2025?

- New instructions for injured spouse (Form 8379).

What’s Covered in This Section?

- Who qualifies and how to request injured spouse relief.

- The innocent spouse requirements under IRC §§6015 and 66(c).

- How to request innocent spouse relief.

- The innocent spouse relief investigation and appeals process.

- The requirements to contest an invalid joint return election.

What’s Not Covered — and Why?

- Tax Court review of denied innocent spouse determinations: innocent spouse cases are rare and not many are contested to the U.S Tax Court (only nine Tax Court opinions on innocent spouse relief cases were issued in 2023). However, many taxpayers are denied and must then request an IRS appeal and consider petitioning the Tax Court based on a sustained denial in IRS Appeals. Taxpayers considering petitioning the Tax Court should engage an experienced tax attorney.

- In-depth review of community property state allocations: taxpayers who file separate returns in community property states and request relief from joint and several liability from understatements or underpayments from their spouse. Taxpayers computing their relief should consider the detailed rules on computing the allocable items on their return according to their state’s community property rules.

Most Common Taxpayer and Tax Professional Actions Performed When Addressing Late Filed Return Issues

- Researching past debt owed by a spouse and evaluating injured spouse relief.

- Completing a request for injured spouse relief and following up with the IRS on the status of the refund.

- Evaluating whether a taxpayer meets the requirements for requesting relief from joint and several liability.

- Requesting and advocating for innocent spouse relief under IRC section 6015.

When to Get an Expert Involved

- Preparing injured spouse requests on complex tax returns: a general rule is that if the taxpayer required a professional to prepare the return, the professional should also prepare the injured spouse request.

- All innocent spouse requests: many taxpayers cannot objectively weigh their facts and circumstances against the complex requirements for innocent spouse relief. As such, taxpayers should use an independent professional who is experienced in the factors that determine relief. The tax professional can also explain the process, who is involved, and extract the right information for the IRS to consider. The expert can also weigh alternative options which may be better suited to resolve the issue(s).

- Appeals of innocent spouse determinations: taxpayers requesting an appeal should consult an expert who can better present the facts and provide a clear legal argument for relief.

- Fraud involved: when there are indications of fraud, taxpayers should always consult a qualified attorney.

Professional Assistance Fees

- Injured spouse request: most requests merely require an additional form to be filed with the return. Preparation of the additional form can range from $25-$100, depending on the complexity of the return.

- Innocent spouse — hourly: Ranges from $80-$500 an hour for an EA, CPA, or tax attorney to evaluate the taxpayer for innocent spouse relief, request the relief, monitor status, advocate relief with the IRS technician, and appeal/finalize relief.

- Flat fee: National firms can charge flat fees from $500+ depending on other issues present, number of years involved, and amount in question. If the representation requires handling other issues (i.e., the audit that is causing the understatement), the fees can be higher.

- No fee: Low-income taxpayer clinics can assist taxpayers free of charge.

Closely Related Issues

- Audits/underreporter notices: if the relief requested is from an understatement from an audit or CP2000 notice, the taxpayer should consider appealing the audit/CP2000 determination or even requesting reconsideration of the assessment.

- Collection: taxpayers wanting innocent spouse relief for an underpayment on a joint return may need to pay or obtain a collection alternative with the IRS.

Time to Complete Estimates for Common Unfiled Past Due Solutions/Actions

| Spousal Issue Action | Estimated Hours to Complete | Average Duration Estimate |

| Obtaining tax history and transcripts from the IRS to evaluate assessments and underpayments | <1 hour (best to call IRS by phone) | one day–three weeks (if transcripts come by mail) |

| Obtaining a collection hold with the IRS while preparing an innocent spouse request for relief of underpayment | 1 hour | one day |

| Filing an injured spouse request (Form 8379) | 15 minutes–2 hours; depends on complexity of return | Up to 14 weeks to receive a refund |

| Evaluating innocent spouse relief and preparing Form 8857 and attachments | 4–15 hours, depending on the facts and circumstances | Average is 19 months for an IRS determination, and even longer when more information is required |

| Appeal adverse innocent spouse determination | 10–15 hours | Depending on the venue, can take 7–12 months for a determination. Average appeal adds seven months to determination |

| Requesting an invalid joint return election (with supporting documents) | 4–15 hours, depending on the facts and circumstances | 6–12 months; longer if the Taxpayer Advocate is involved |

INJURED SPOUSE RELIEF

This section provides guidance on who qualifies for injured spouse relief and how to request such relief.

| Topic | Covers | |

| Overview of Injured Spouse Relief | Information on refund offset rules, injured v. innocent spouse relief, debts that can be offset and which trigger injured spouse, and how to identify whether a taxpayer was subject to a refund offset. | |

| Qualifying for Injured Spouse Relief | Criteria for qualifying for injured spouse relief. | |

| Filing for Injured Spouse Relief | Allocation and filing rules for injured spouse relief. | |

| Key Terms and Definitions for Injured Spouse Relief | Common terms and definitions used in injured spouse cases. | |

| Additional Assistance with Injured Spouse: Internal Revenue Manual, Forms, Publications, Notices, Webpages, and Frequently Used Phone Numbers | Injured spouse assistance from IRM sections, forms, publications, notice, web links, and frequently used phone numbers. | |

| Attachments | Form 8379 and instructions to file an Injured Spouse Allocation. |

Other helpful sections:

| Topic | Covers | |

| Evaluating Collection Alternatives | Obtaining a collection alternative for outstanding federal tax debt. | |

| Innocent Spouse Relief | Rules for qualifying and requesting innocent spouse relief. |

Key Highlights:

- A spouse, whose portion of a joint income tax overpayment was, or will be, offset to a federal tax debt or a Treasury Offset Program nontax debt for which he/she is not liable, is known as an “injured spouse.”

- Taxpayers can request injured spouse relief using Form 8379, Injured Spouse Allocation, at the time of filing or after the return is processed as long as the request is timely filed.

- If a taxpayer qualifies for injured spouse relief, the IRS will take between 8-14 weeks to process and pay the allocated refund to the injured spouse.

Overview of Injured Spouse Relief

Internal Revenue Code (IRC) section 6402 requires the IRS to apply a taxpayer’s tax refund to any past-due federal tax debt, child or spousal support debt, federal agency nontax debt (such as a student loan), or state income tax obligation before issuing a refund. Applying a tax refund to a past-due debt is referred to as a “refund offset.” [IRM 21.4.6.2 (9-6-2022)]

If a taxpayer files a joint tax return resulting in a refund, that refund may be used to pay the past-due amounts of either spouse’s debts. However, the IRS can refund all or a portion of a refund if the taxpayer qualifies as an “injured spouse.” An injured spouse is a taxpayer who files a joint tax return for which all or part of his or her share of the tax refund was, or is expected to be, applied against the other spouse’s past-due debt.

Upon request, the IRS must repay the non-debtor, injured spouse’s share of the refund. This request is called an injured spouse allocation request.

Example: John and Mary file a joint return. John has past-due child support obligations that are subject to collection. John and Mary file their joint tax return for 2020. They know that John’s portion of his refund will be taken to pay the past-due child support. Knowing that their refund will be offset, Mary includes an injured spouse allocation (Form 8379) in their 2020 return identifying the allocable portion of her income, expenses, credits, tax, and payments. The IRS processes the return with the Form 8379 and keeps John’s portion of his refund to pay his past-due child support. Mary receives her refund.

Injured Spouse v. Innocent Spouse

Injured spouse and innocent spouse relief are frequently confused with each other. Innocent spouse relieves a spouse of the responsibility for paying taxes which are owed, jointly and severally, with a spouse. [IRC §6015] Injured spouse relief involves obtaining a refund for a taxpayer whose allocable refund was used to pay their spouse’s past-due debt. [IRC §6402]

Injured spouse is the most common spousal issue. In 2022, the IRS processed and closed 181,395 injured spouse cases. [IRS FOIA Response 2023-00922, 10/5/2022]

Example: Jack and Jill file a joint return. Jack and Jill get audited. After two years, the IRS assesses an additional tax bill of $100,000 due to Jack’s gambling income. Jill did not have any knowledge or benefit from that income and owes the IRS $100,000. Jill wants to explore relief options from having to pay the audit bill. Injured spouse relief does not apply to Jill because the tax bill is assessed against both of them on their joint return. Jill must explore the innocent spouse provisions to see if she qualifies for relief for joint and several liability.

Debts That Can Be Offset

There are two types of debt subject to refund offset: federal tax debts and non-tax debts that are collected through the U.S. Bureau of the Fiscal Service’s Treasury Offset Program (TOP).

Federal tax debts include:

- Taxes owed by the primary and secondary taxpayer, including income taxes.

- Individual Return Account taxes reported on Form 5329, Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts.

- Individual Shared Responsibility Payment liabilities.

- Any civil penalties assessed.

- Associated business tax debts.

TOP debts include certain obligations reported to the IRS, including:

- Past-due child support.

- Federal agency non-tax debts.

- State income tax obligations.

- Certain unemployment compensation debts owed to a state (usually for unemployment compensation paid due to fraud or contributions owing to a state fund that were not paid).

Disputes over the TOP nontax debts cannot be resolved with the IRS. Taxpayers must contact the TOP Call Center. If a refund is offset due to a TOP debt(s), the taxpayer will receive a notice from the Bureau of the Fiscal Service. [IRM 21.4.6.5.8.10.2 at (2) (9-6-2022)]

Identifying Refund Offsets on IRS Account Transcripts

Taxpayers can identify refund offsets using their IRS account transcripts. [See ¶102 for more on IRS transcripts]

Refund offsets are applied to outstanding federal tax debts first. [IRM 21.4.6.4 at (3) (10-1-2021)] Refund offsets to unpaid taxes can be found on the following IRS account transcript transaction codes (TC): [IRM 21.4.6.4.1 (12-4-2014)]

- TC 820/826, tax offset: the overpayment is transferred to another tax year/form.

- TC 896, computer-generated tax offset: the overpayment is usually used to pay associated business tax debt, Individual Retirement Account assessments, or outstanding healthcare Individual Shared Responsibility Payments.

The IRS is triggered to collect non-tax related debts through the Treasury Offset Program. This program sends the IRS data weekly to update whether a non-tax debt exists that can be collected by the IRS. [IRM 21.4.6.5.8.3 at (6) (10-1-2023)] Refund offsets applied to Treasury Offset Program (TOP) debts are applied in this order: first to back child support obligations, then other federal agency debts, state income tax obligations, and unemployment compensation. [IRM 21.4.6.4 at (4) (10-1-2021)]

Refund offsets to TOP non-tax debts can be found on IRS account transcript transaction code (TC) TC 898. [IRM 21.4.6.4.2 (1-20-2017)]

Qualifying for Injured Spouse Relief

A taxpayer qualifies as an injured spouse if he or she is not required to pay any past-due amounts and meets any of the following criteria:

- The injured spouse made and reported tax payments (i.e., they had federal income tax withholdings from wages or estimated tax payments).

- The injured spouse had earned income (i.e., wages, salaries, or self-employment income) and claimed the earned income credit or the additional child tax credit.

- The injured spouse claimed a refundable tax credit, such as the premium tax credit or the refundable credit for prior year minimum tax.

If a taxpayer believes he or she qualifies as an injured spouse, he or she should file a Form 8379, Injured Spouse Allocation, with the IRS to get back his or her share of a refund. [IRM 25.15.1.2.5 (6-26-2017)] The IRS instructs a taxpayer to attach a Form 8379 to his or her original tax return either when submitting a paper tax return or when filing electronically. If a Form 8379 was not filed with the original tax return, the IRS instructs a taxpayer to submit a paper request to the same address where the taxpayer would file their original return.

Filing for Injured Spouse Relief

If a taxpayer qualifies as an injured spouse, he needs to file a Form 8379, Injured Spouse Allocation, with the IRS to get back his share of the refund. [IRM 25.15.1.2.5 (6-26-2017)]

Computing Overpayment Due to the Injured Spouse

To compute the amount of tax owed and resulting overpayment due to each spouse, the taxpayer will need to allocate his separate income, expenses, and credits to the spouse who would have shown the item(s) on his separate return.

IRM 21.4.6.5.8.4 (10-1-2021) provides guidance on how to allocate the return items:

- Income, deductions, personal exemptions, credits and payments shown on the joint return must be allocated to the spouse to whom they belong. [Rev. Rul. 80-7]

- All income on the joint return must be reported on the Form 8379.

- The taxable amount of unemployment compensation and Social Security benefits shown on the joint return must be used when allocating the separate adjusted gross income for each spouse.

- Income, withholding, expenses, and other taxes must be allocated to the spouse to whom they belong.

- Child tax credit, child and dependent care credit, and an additional child tax credit must be allocated to the spouse who is allocated the qualifying child’s exemption.

- Qualified business income deduction must be allocated based on the percentage of each spouse’s qualified business income.

- Student loan interest deduction, IRA deductions, and other deductions must be allocated to the spouse obligated to the loan, owner of the IRA, etc. However, the taxpayer can choose the allocation method.

- If the taxpayers cannot agree on the allocation of the estimated tax payments, the IRS will allocate the estimated tax payments based on the ratable percentage of each spouse’s tax liability (computed using married filing separately).

- Earned income tax credit must be allocated if the injured spouse has qualifying earned income and the EITC was included on the original return.

The allocation is made on Form 8379, Injured Spouse Allocation. The IRS will compute the amount of any refund due to the injured spouse.

Methods to Request Injured Spouse Relief

The IRS instructs a taxpayer to attach a Form 8379 to his or her original tax return either when submitting a paper tax return or when filing electronically. If a Form 8379 was not filed with the original tax return, the IRS instructs a taxpayer to submit a paper Form 8379 to any one of the ten IRS campuses based on where the taxpayer filed the original return. Taxpayers can also file Form 8379 with any subsequent amended return.

For each of the three methods to request injured spouse, the timeframes for processing each are as follows: [Instructions to Form 8379]

| File Form 8379: | Time for IRS processing: |

| With the original return | If filed electronically, 11 weeks. If filed by paper, 14 weeks. |

| Separately after the original joint return is processed | Eight weeks. |

| With any subsequent amended return | Amended return timeframes — generally more than 16 weeks. |

IRS procedures require processing of the Form 8379 within 45 days (the 45 days starts on the later of the return due date, return received date, or the return processable date) to avoid paying interest to the taxpayer. [IRM 21.4.6.5.8.3 at (1) (10-1-2023)] Traditionally, the IRS often takes longer than 45 days to process Form 8379.

Practice Tip: As of October 1, 2022, the overage rate (> 45 days to process) on injured spouse claims was 80% due to paper backlogs at the IRS. [IRS FOIA Response 2023-00922, 10/5/2022] As the IRS reduces the backlogs in 2023 and beyond, the processing times will improve.

If the taxpayer does not file the Form 8379 with the original timely filed return, they will need to file it within three years from the due date of the original return (including extensions) or within two years from the date they paid the tax that was late offset, whichever is later. [IRC §6511(a) and IRM 21.4.6.5.8.10 (9-6-2022)]

When filing Form 8379 separately, taxpayers need to attach a copy of all Forms W-2 and W-2G for both spouses, and any Forms 1099 showing federal income tax withholding, to Form 8379. [Instructions to Form 8379] Taxpayers should not send a copy of their joint return with the separate Form 8379 request.

If the requesting injured spouse is filing the Form 8379 separate from the return, she will need to sign and date the form. The debtor spouse does not need to sign. Signatures are not required when the Form 8379 is filed with the return.

Community Property State Rules

There are special rules in community property states. Community property states include Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. [IRM 21.4.6.5.9 (10-1-2020)] Taxpayers who live in a community property state will calculate the injured spouse refund using special rules. In community property states, overpayments are considered joint property and are generally applied (offset) to legally owed past-due obligations of either spouse.

The IRS will use each state’s rules to determine the amount, if any, that would be refundable to the injured spouse. [Instructions to Form 8379]

Applicable rules are found in specific IRS Revenue Rulings for each state:

| State | Revenue Ruling |

| Arizona, Wisconsin | Revenue Ruling 2004-71 |

| California, Idaho, Louisiana | Revenue Ruling 2004-72 |

| Nevada, New Mexico, Washington | Revenue Ruling 2004-73 |

| Texas | Revenue Ruling 2004-74 |

Under state community property laws, 50% of a joint overpayment (except the earned income credit) is applied to non-federal tax debts such as child support, student loans, state unemployment compensation debts, or state income tax. State laws differ on the amount of a joint overpayment that can be applied to a federal tax debt. Earned Income Tax Credit (EITC) must be allocated without regard to community property laws. The earned income credit is allocated to each spouse based on each spouse’s earned income. [IRM 21.4.6.5.9 (10-1-2020)]

The IRS will determine, using the specific state rules, the amount to be refunded to the injured spouse.

Key Terms and Definitions for Injured Spouse Relief

The following terms are often referenced in injured spouse cases:

| Term | Definition |

| Injured spouse | A taxpayer who files a joint tax return for which all or part of his or her share of the tax refund was, or is expected to be, applied against the other spouse’s past-due debt. |

| Innocent spouse | A provision that provides relief for a spouse, in certain circumstances, from the joint and several liability as a result of filing a jointly filed return. |

| Non-tax debts | Includes debt collected through the Treasury Offset Program (TOP) including past-due child support, federal agency non-tax debts, state income tax obligations, and certain unpaid state unemployment compensation debts. TOP collects these debts through taxpayer’s federal refunds. |

| Refund offset | Applying a tax refund to a past-due debt. |

| Tax debts | Includes federal tax debts such as unpaid income taxes, associated business tax debt, Individual Retirement Account assessments, or outstanding healthcare Individual Shared Responsibility Payments. IRS refunds are taken to offset these debts. |

| Treasury Offset Program (TOP) | The U.S. Bureau of the Fiscal Service’s centralized offset program which collects delinquent debts owed to federal agencies and states. |

Additional Assistance with Injured Spouse: Internal Revenue Manual, Forms, Publications, Notices, Webpages, and Frequently Used Phone Numbers

The following IRM sections provide guidance with injured spouse requests:

| IRM Section | Section | Post-filing help for: |

| IRM 21.4.6 | Refund Offset | IRS refund offset procedures and injured spouse allocation processing. |

| IRM 25.18.5 | Community Property-Injured Spouse | IRS procedures on processing injured spouse requests for taxpayers living in community property states. |

Publications that assist with injured spouse requests:

| Publication | Title | Date |

| Instructions to Form 8379 | Instructions for Form 8379, Injured Spouse Allocation | 11/2023 |

| Pub. 555 | Community Property | 3/2020 |

Forms for injured spouse issues:

| Form | Title | Date |

| Form 8379 | Injured Spouse Allocation | 11/2023 |

Notices used in injured spouse cases:

| Notice/Letter # | Title | Used for: |

| Letter 3179C | Refund Offset to Treasury Offset Program (TOP) and Injured Spouse Inquiries | Response letter to TOP offsets. [IRM 21.4.6.5.2 at (8) (10-1-2023)] |

| Letter 285C | Refund/Overpayment Applied to Account | Response letter for tax offsets. [IRM 21.4.6.5.2 at (8) (10-1-2023)] |

| Letter 916C | Claim Incomplete for Processing; No Consideration | IRS notification that Form 8379 cannot be processed because it was not timely filed. |

Helpful webpages for injured spouse issues:

| Webpage | URL | Description |

| IRS Reduced Refund Topic page | https://www.irs.gov/taxtopics/tc203 | Treasury Offset Program refund offset rules and information. |

| Bureau of Fiscal Service: Treasury Offset Program | https://fiscal.treasury.gov/top/ | Information on how the Bureau of Fiscal Service collects delinquent debts owed to federal agencies and states. |

Common IRS assistance hotlines to help with injured spouse issues:

| IRS Hotline | Phone number | Hours/availability |

| Individual accounts | (800) 829-1040 | For taxpayers, tax pros use PPS. M-F, 7AM-7PM, local time. |

| Taxpayer Advocate National Hotline (central intake) | (877) 777-4778 | M-F, 7AM-7PM, local time. Local offices: 8AM-4:30PM |

| Practitioner Priority Service (tax professionals only) | (866) 860-4259 Option #2: Individual accounts | M-F, 7AM – 7PM, local time. |

| Bureau of the Fiscal Service – TOP Call Center | (800) 304-3107 | M-F, 8:30AM – 6:00PM (ET)—also has automated service. |

Attachments

| Form/Publication | Title | |

| Form 8379 (11/2023) | Injured Spouse Allocation | |

| Instructions for Form 8379 (11/2023) | Instructions for Form 8379, Injured Spouse Allocation |

INNOCENT SPOUSE RELIEF

This section provides guidance on the requirements for innocent spouse relief and how to request relief from joint and several liability.

| Topic | Covers | |

| Overview of Innocent Spouse Relief | What is innocent spouse, the types of innocent spouse relief, and how innocent spouse relief works. | |

| Key Terms and Definitions for Innocent Spouse Relief | Common terms used in innocent spouse requests and determinations. | |

| Relief for Regular Innocent Spouse: IRC §6015(b) | The requirements for innocent spouse relief under section 6015(b). | |

| Relief for Separation of Liability: IRC §6015(c) | The requirements for innocent spouse relief under section 6015(c). | |

| Equitable Relief: IRC §6015(f) | The requirements for innocent spouse relief under section 6015(f). | |

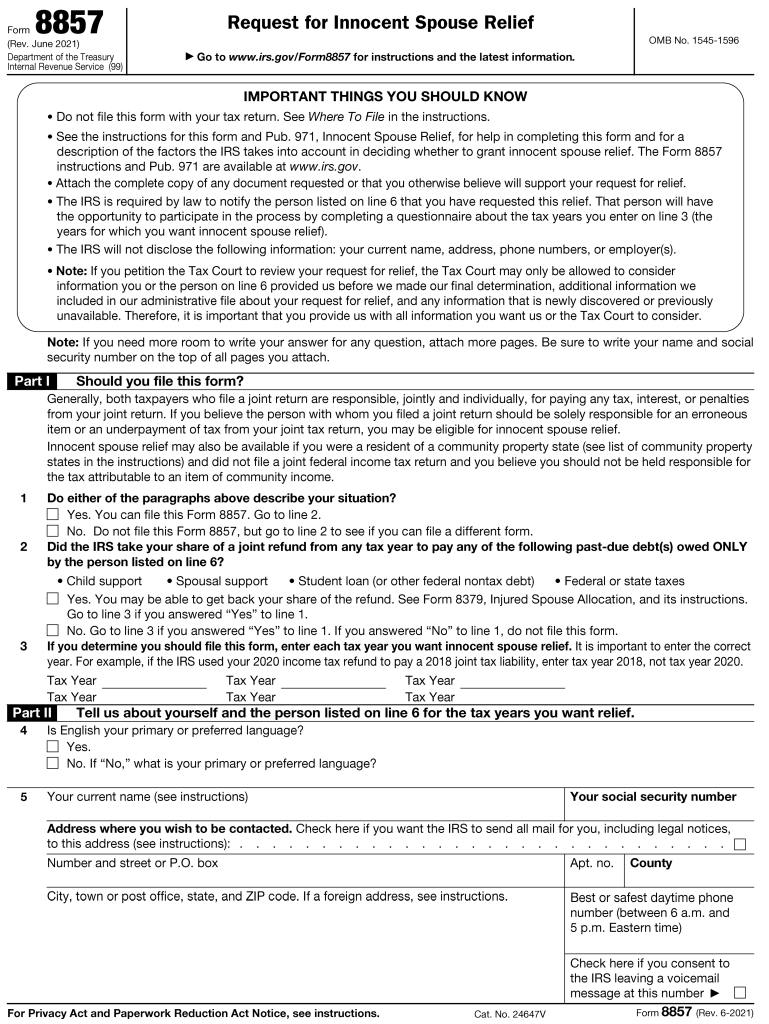

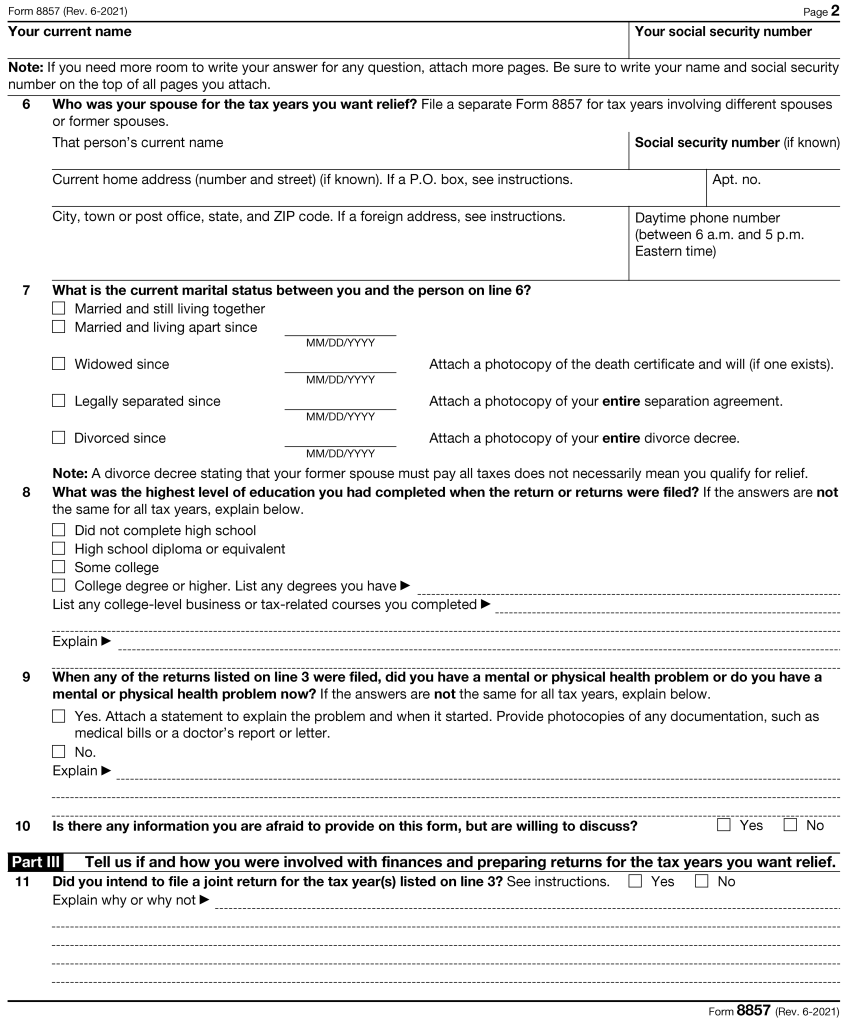

| Requesting Innocent Spouse Relief | How to request innocent spouse relief, including what documents to attach to the request. | |

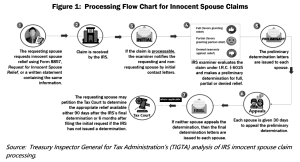

| Innocent Spouse Investigation Process | The steps taken by the IRS to investigate a request for innocent spouse relief. | |

| Appealing Adverse Innocent Spouse Determinations | How to appeal an adverse innocent spouse determination. | |

| Additional Assistance with Injured Spouse: Internal Revenue Manual, Forms, Publications, Notices, Webpages, and Frequently Used Phone Numbers | Additional information for evaluating and requesting innocent spouse relief and contacting the IRS about an innocent spouse request. | |

| Resources | Attached resources to help with innocent spouse requests. |

Other helpful sections:

| Topic | Covers | |

| Overview of IRS Audits and Underreporter Notices | Resolving an audit or underreporter notice (i.e., an understatement). | |

| Evaluating Collection Alternatives | Obtaining a collection alternative for outstanding federal tax debt (i.e., underpayments). | |

| Injured Spouse Relief | Rules for qualifying and requesting injured spouse relief. |

Key Highlights:

- Taxpayers who file a joint return are jointly and severally liable for the balance due with the return and any additions to tax that may arise after the return is filed.

- In certain circumstances, if the error or underpayment is due solely to the actions of one spouse, the other spouse may be relieved of the liability if they qualify for one of the types of innocent spouse relief.

- Innocent spouse relief determinations are often subjective. The determination is based on a facts and circumstances test, and not a bright line test for relief. As a result, innocent spouse relief is rare and is often contested by the IRS. Taxpayers should closely review their facts and circumstances and prior IRS decisions when evaluating and advocating for innocent spouse relief.

Overview of Innocent Spouse Relief

When a married couple elects to file a joint tax return, they are equally liable for the taxes due with the return and additional taxes, penalties, and interest that might arise from errors on the return. This is true even if a divorce decree states that a former spouse will be responsible for any amounts due on previously filed joint returns.

A spouse who is held liable for the actions and errors solely by their spouse may be able to request relief if they qualify as an “innocent spouse.” To qualify as an Innocent spouse, the spouse must meet the requirements of one of the relief provisions of IRC §6015, Relief from Joint and Several Liability on Joint Return. If they qualify, the innocent spouse can request to be relieved of the all or part of the tax owed by the spouse. This relief is called “innocent spouse relief.”

In addition to the innocent spouse relief provisions of IRC §6015, spouses who do not file a joint return in a community property state may also qualify for innocent spouse relief under IRC §66(c) in certain circumstances. Taxpayers residing in “community property” states are subject to different rights and responsibilities with respect to property rights, including income and associated taxes. Taxpayers in these states can also request innocent spouse relief from liability resulting from community property laws under IRC §66(c), Treatment of Community Income. Each spouse domiciled in a community property state is generally liable for income tax on one-half of the community income when the spouses do not file a joint return. However, IRC §66 grants relief from the income splitting requirements in certain circumstances.

Practice Tip: Innocent spouse relief is often not requested by taxpayers. Often, taxpayers in potential innocent spouse situations are under emotional stress due to their circumstances and cannot endure the several months of IRS investigation into the innocent spouse relief request. In addition, taxpayers are often confused about the requirements to request relief and the hazards involved in requesting relief. Because qualification and determinations are based on the facts and circumstances, and not a bright-line test, taxpayer are often confused about IRS adverse determinations that often appear to be based on subjective determinations by IRS examiners. If an adverse determination is proposed, the taxpayer must further navigate the myriad of appeals options to request a second look at the initial denial. Consider how few requests for innocent spouse are made and the high rate of appeal: for the tax year 2021, there were 54.2 million jointly filed returns. [IRS Publication 4801] In 2019, the IRS received only 37,462 innocent spouse requests. [IRS FOIA 2020-09386] Only 17% of these requests were granted. In 2019, the IRS received 1,575 new appeals cases related to rejected innocent spouse requests. [IRS Data Book, 2019, Table 27] (Note: In 2022, there were 1,339 appeals cases for innocent spouse issues.) However, many taxpayers do not take their innocent spouse issue to a court decision. In 2023, there were only nine innocent spouse Tax Court decisions. [Taxpayer Advocate Report to Congress for 2023] Innocent spouse requests are one of the IRS’s most litigated issues, but with few decisions being made as most are resolved administratively within the IRS. Also, when the case is litigated, the IRS has won two-thirds of all cases that are brought to court. [Taxpayer Advocate Service, 2017 Annual Report to Congress, Volume One, Most Litigated Issues] Taxpayers should clearly understand the requirements for innocent spouse and be prepared to support their positions when requesting and advocating for innocent spouse relief. Due to the amount of subjectivity in the determination process, taxpayers should be prepared to support their position by citing prior court rulings and IRS procedures found in the IRS’s Internal Revenue Manual and Revenue Procedure 2013-34. Taxpayers should also be prepared to appeal and/or litigate their case if needed.

Types of Innocent Spouse Relief

Certain married, separated, and divorced taxpayers who have filed a joint return may request relief from the joint liability under one of three types of relief:

- IRC §6015(b) — “Regular” Innocent Spouse Relief: this provision provides the innocent spouse relief from a deficiency/understatement of tax liability.

- IRC §6015(c) — Separation of Liability: this provision allows the innocent spouse to allocate a deficiency/understatement to a tax liability.

- IRC §6015(f) — Equitable Relief: this provision provides the IRS discretion to grant equitable relief from deficiencies and underpayments if the relief provisions under sections 6015(b) or 6015(c) do not apply.

Each type of relief has its own rules to qualify. Taxpayers first look for relief under IRC §§6015(b) and (c). If they do not qualify for relief under these two sections, they can look for relief under section 6015(f).

Under sections 6015(b) and (c), relief is available only from an understatement (i.e., a deficiency from an additional assessment due to an audit or underreporter notice). Sections 6015(b) and (c) do not allow relief from an underpayment of income tax reported on a joint return (i.e., filed returns with an unpaid balance). Sections 6015(f) (equitable relief) and 66(c) (community property relief) permit relief from an underpayment of income tax or from a deficiency.

Comparison of Innocent Spouse Relief Types

Innocent spouse relief is complicated. Taxpayers will need to understand each type to understand if they qualify for relief. In addition, taxpayers filing separate returns in community property states will need to evaluate relief under IRC §66(c).

| Comparison Chart of Types of Innocent Spouse Relief | |||

|---|---|---|---|

| Type | Regular Innocent Spouse Relief | Separation of Liability | Equitable Relief |

| Section | 6015(b) | 6015(c) | 6015(f) |

| Relief | Understatement only (post-filing deficiency assessment, i.e., an audit or CP2000 result) | Understatement and underpayment | |

| Concept | Relief is warranted when the requesting spouse did not know or have reason to know of the understatement. | Relief is warranted when divorced or separated spouses have the tax liability allocated proportionally between them as if they had filed separate returns | Relief is warranted when it is inequitable to hold the requesting spouse liable for the unpaid tax, but the individual does not qualify for regular or separation of liability relief |

| Time to file | Within two years of first collection action. | Before collection (CSED) or refund statute expiration dates (RSED) | |

| Refund of amounts paid | Available if timely filed. | No refunds available. | Available if timely filed. |

| Requirements for relief | Five requirements:

|

Spouse did not know or have reason to know about the item or items that resulted in the understated tax and:

|

Seven requirements:

|

| IRS website info | https://www.irs.gov/individuals/innocent-spouse-relief | https://www.irs.gov/individuals/separation-of-liability-relief | https://www.irs.gov/individuals/equitable-relief |

Taxpayers in community property states that file a separate return can also get relief for understatements and underpayment under the Regular Innocent Spouse Relief or Equitable Relief.

Other Factors to Consider When Considering Innocent Spouse Relief

Taxpayers requesting innocent spouse (RS) relief are often separated or divorced from their prior spouse. When requesting relief, taxpayers need to know that the non-requesting spouse (NRS) will be notified and asked to participate in the determination. The IRS will protect the privacy and return information of the RS, including the current location of the RS. [IRM 25.15.3.4 (12-12-2016)]

The NRS is notified of the RS innocent spouse claim by issuance of Letter 3284/3284-C, Notification to the Non-Requesting Spouse. The letter notifies the NRS of the request for relief and solicits additional information with a 30-day response time. The notification letter is sent to the NRS’ last-known address.

In addition, before filing the request, the RS may want to inquire if the outstanding tax is being paid by the NRS. The RS may discover that the NRS is already paying the tax owed through an installment agreement. He or she may also find out if the former spouse is not paying the tax and whether the IRS will pursue the RS for payment. Taxpayers facing collection of a deficiency or balance owed related to joint liabilities with a former spouse (either divorced or no longer living together) can obtain important information about the return and collection of outstanding balances against the former spouse from the IRS. [IRC §§6103(e)(7) and (8) and IRM 25.15.1.9.2 (4-2-2020)]

Pursuant to IRC §6103(e)(8), the following information must be disclosed in writing, upon written request to the taxpayer or the taxpayer’s authorized representative:

- Whether the IRS has attempted to collect the deficiency from the other spouse.

- The amount, if any, collected from the other spouse.

- The current collection status (i.e., balance due, installment agreement, collection suspended).

- The reason for any suspension of collection activity, if applicable (i.e., unable to locate, hardship, currently not collectible, etc.).

The IRS will not disclose the following information:

- The other spouse’s new last name, location, or telephone number.

- Any information about the other spouse’s employment income or assets.

- The income level at which a suspended account will be reactivated if the NRS is in currently not collectible status.

Practice Tip: The information can also be provided to the taxpayer or their representative by phone. However, the IRS is inconsistent in applying this rule. Taxpayers or their representatives can contact IRS Collection to obtain this information. If the information is denied, the taxpayer can write to the IRS or contact the IRS Taxpayer Advocate to obtain this information. [IRM 25.15.1.9.2 at (3) (4-2-2020)]

NRS Participation in the Innocent Spouse Investigation

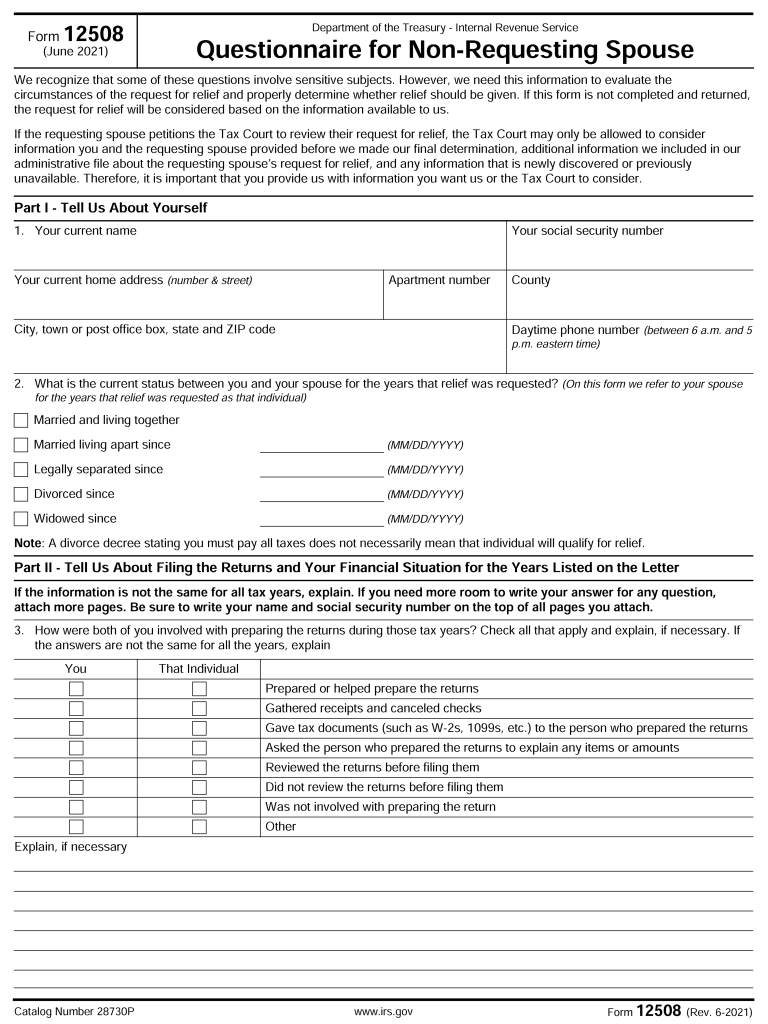

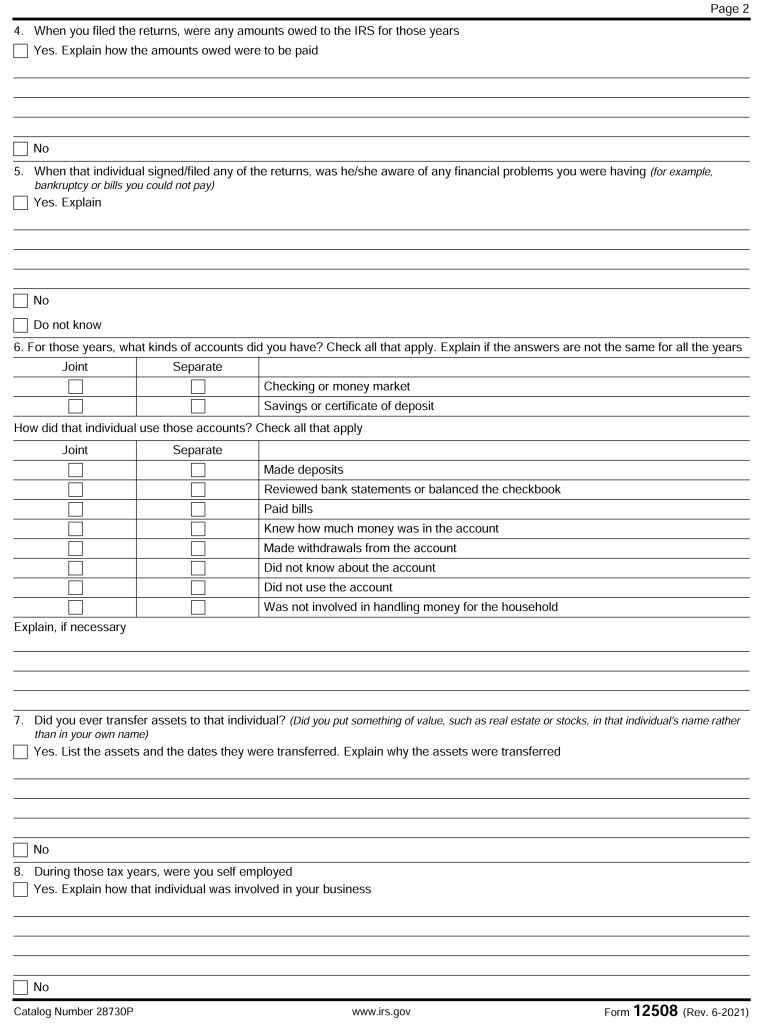

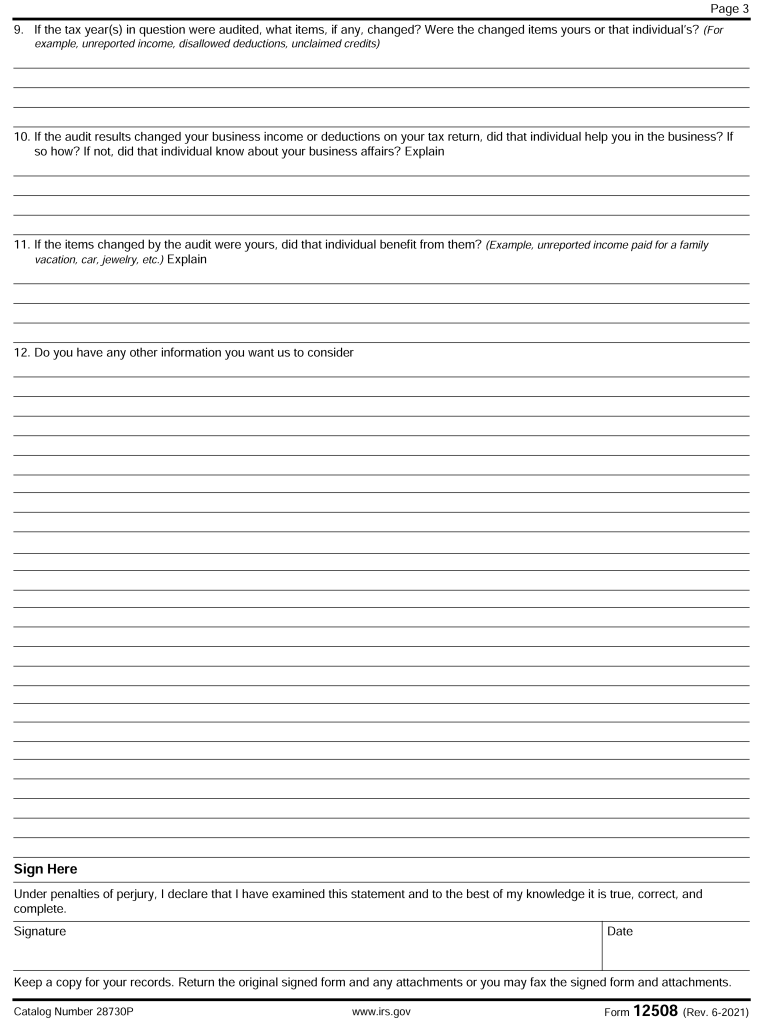

The non-requesting spouse (NRS) must be notified and given an opportunity to participate in any administrative proceedings involving an innocent spouse claim. [IRC §6015(h)(2) and IRM 25.15.3.4 (12-12-2016)] This includes being notified of the RS’ innocent spouse relief request via Letter 3284/3284-C. [IRM 25.15.3.4 (12-12-2016)] This letter can also solicit additional information from the NRS. The IRS often sends Form 12508, Questionnaire for Non-Requesting Spouse, to the NRS to ask them for information related to the request. [See ¶602.10 for a copy of the Form 12508]

The NRS will also be notified of the IRS’s preliminary and final determinations. [Treasury Regulation §1.6015-6(a)(2) and IRM 25.15.3.4 at (4) (12-12-2016)]

If full or partial relief is granted to the RS, the NRS can file a protest and receive an administrative conference in the IRS Independent Office of Appeals if they are still liable for the tax (i.e., did not discharge in bankruptcy or through an offer in compromise). [IRM 25.15.3.4 (12-12-2016)]

The Appeals’ decision is final for the NRS. The NRS may not petition the Tax Court to appeal the IRS’s administrative determination regarding IRC §6015 relief. [IRM 8.7.12.6 at (5) (6-10-2021) and Revenue Procedure 2003-19] However, the RS may petition the Tax Court for review of the IRS’s determination and, in those situations, the NRS must receive notice of the Tax Court proceeding and has an unconditional right to intervene in the proceeding to dispute or support the RS’s claim for relief. [IRM 8.7.12.9.3.2 at (3) (6-10-2021)]

Time Period for Filing Form 8857

The RS must file a request for relief with the IRS under IRC §§6015(b) and (c) no later than two years from the date of the first collection activity against the RS. [IRM 25.15.1.6.2 (6-26-2017)]

Events considered first collection activity include:

- Refund offset of an overpayment of the RS against the joint liability.

- Collection Due Process hearing notice notifying the taxpayer of the IRS’s intent to levy.

- Collection suit filed by the United States against the RS for the collection of the joint liability.

- Claims in judicial proceedings filed by the IRS in which the RS is a party, such as a bankruptcy proceeding.

Events not considered first collection activity include:

- A notice of deficiency (i.e., from an audit, CP2000 notice, or SFR activity).

- Demands for payment of tax.

- A Notice of Federal Tax Lien.

For equitable relief under section 6015(f), the claim is timely as long as the refund statute or collection statute is open.

All requests for refund of payments must be filed within the normal time frame for filing a claim for refund (i.e., before the refund statute expiration date (“RSED”)). The claim must be filed within the later of two years from the date of payment or three years from the date the return is filed. [IRM 25.15.1.6.2 (6-26-2017)]

Community Property State Rules

Each spouse domiciled in a community property state is generally liable for income tax on one-half of the community income when the spouses do not file a joint return. [IRM 25.15.5.1.1 (7-24-2017)] As such, when an error is made on the return of a spouse in a community property state, the spouse who did not make the error can be liable for the additional tax.

If a taxpayer files a joint return in a community property state, he is jointly and severally liable. However, community property laws are not considered in determining whether an item belongs to the RS or the NRS when requesting relief from joint and several liability. Under IRC §6015, a spouse may be eligible for relief from joint and several liabilities attributable to a joint return. Determinations under IRC §6015 are made without regard to community property. [IRM 25.15.5.1.1 (7-24-2017)]

Community property state innocent spouse relief is available to taxpayers residing in Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin who do not file a joint return under IRC §66(c).

IRC §66(c) relief is not available if the spouse:

- Filed a joint return,

- Transferred assets to the other spouse as part of a fraudulent scheme,

- Entered into a closing agreement that disposed of the same liability, or

- Entered into an offer in compromise for the liability.

[IRM 25.15.5.11 (7-24-2017)]

Community property laws vary greatly from state to state based upon each individual state’s statutes. The community property laws of the state where the spouses are domiciled controls and needs to be reviewed when any tax issue involves the application of community property laws. IRS Publication 555, Community Property, and IRM Exhibit 25.18.1-1, Comparison of State Law Differences in Community Property States, provide a summary of how to apply community property laws by state.

Spouses domiciled in community property states may file tax returns either jointly or separately. The spouses generally have an undivided one-half interest in the community income so any separate return should reflect one-half of the community income plus 100% of their separate income.

IRC §66(c) provides two additional exceptions to the general rule that community income is taxed one-half to each spouse: traditional (“regular”) relief and equitable relief.

Traditional relief under IRC §66(c) applies only to deficiency cases. If relief is granted, the NRS will be solely liable for the tax liability attributable to the item of community property income. [Treasury Regulation §1.66-4]

Traditional relief under IRC §66(c) has the following requirements:

- A joint return was not filed for the taxable year for which the RS seeks relief. (If a joint return was filed, IRC §66(c) does not apply; relief on a jointly filed return may be available under IRC §6015.)

- The RS does not include in gross income an item of community income which would be attributable NRS under the community property rules (i.e., wages, business, partnership or income from separate property of the NRS),

- The RS establishes he/she did not know and had no reason to know of such item of community income, and

- Considering all the facts and circumstances, it is inequitable to include such community item in the RS’s gross income.

If all of the above requirements are met, then the unreported item of income will be taxed wholly to the NRS, and not split between the NRS and the RS.

The knowledge requirement is a facts and circumstances test. For purposes of the knowledge requirement of IRC §66(c), a RS has knowledge or reason to know if he or she actually knew of the item of community income or a reasonable person in similar circumstances would have known of the item of community income. Relevant factors include, but are not limited to, the nature of the item of community income, the amount of the item relative to other income items, the couple’s financial situation, the RS’s educational background and business experience, and whether the item of community income was reflected on prior years’ returns (i.e., investment income omitted that was regularly reported on prior years’ returns). [Treasury Regulation §1.66-4(a)(2) and IRM 25.15.5.14.1 at (3) (7-24-2017)]

The IRM points out that the knowledge requirement is interpreted strictly. If a spouse is aware of the source of community income or an income producing activity, the RS is considered to have knowledge or reason to know of the item of community income even if the spouse did not know the specific amount received. [IRM 25.15.5.14.1 at (4) (7-24-2017)]

The determination whether it would be inequitable to hold a spouse liable is also a facts and circumstances test. An important factor to be considered is whether the spouse significantly benefited, directly or indirectly, from the item. This includes consideration of whether any transfers of property or rights to property, including transfers several years after the fact benefitted the spouse. Normal support is not a significant benefit. [IRM 25.15.3.9.4.1.5 (7-29-2014)] Other factors considered include desertion, divorce or separation. [Treasury Regulation §1.66-4(a)(3), Revenue Procedure 2013-34, and IRM 25.15.5.14.1 at (5) (7-24-2017)]

The time period to request traditional relief is as follows:

- The earliest time for submitting a request for an amount omitted from the RS’s separate return, is the date the RS receives notification of an audit or a letter or notice from the IRS stating there may be an outstanding liability with regard to that year. [Treasury Regulation §1.66-4(j)]

- The latest time for requesting relief, except for requests for equitable relief, is no later than six months before the expiration of the period of limitations on assessment, including extensions, against the NRS for the taxable year that is the subject of the request for relief, unless the examination of the RS’s return commences during that six-month period. If the examination of the RS’s return commences during that six-month period, the latest time for requesting relief is 30 days after the commencement of the examination.

[IRM 25.15.5.16.1 (7-24-2017)]

If the RS does not qualify for traditional relief under IRC §66(c), equitable relief can be considered. If taking into account all the facts and circumstances, it is inequitable to hold the RS liable, then the IRS will consider equitable relief under IRC §66(c). Relief is available for both understatement and underpayment cases. To qualify for equitable relief, a RS must meet the same requirements (except the joint return filing and the unavailability of section 6015(c)) as for equitable relief under IRC §6015(f) and Revenue Procedure 2013-34. [See ¶602.05 for the requirements for equitable relief]

The time period within which to request equitable relief is as follows:

- The earliest time for submitting a request for equitable relief relating to a deficiency is the date the RS receives notification of an audit or a letter or notice from the IRS stating there may be an outstanding liability with regard to that year.

- The earliest time for submitting a request for equitable relief relating to a liability properly reported but unpaid is upon the filing of the individual federal income tax return.

- The latest time for requesting equitable relief is within any time period that the collection statute or refund statute remains open.

- [IRM 25.15.5.16.2 (7-24-2017)]

If relief is granted, the item of community income is included in the gross income of the NRS and not in the gross income of the RS as long as the statute of limitations on assessment is still open. [IRM 25.15.5.14.2 at (5) (07-24-2017)]

Invalid Joint Return Election

One argument against joint and several liability is that the spouse never signed or intended to sign the return. In this case, the spouse will claim that the return contains an invalid joint election.

This can occur if the spouse did not sign the return, the signature on the return was forged, or the spouse signed under duress.

If the spouse does not sign the return, the spouse will also have to have to show that there was no indication of intent to file a joint return. In these cases, the spouse will have to prove that the signature was forged and that there was no “tacit consent” to file a joint return. [IRM 25.15.19.2.5 at (2) (10-23-2019)]

Tacit consent means that the joint return is valid even though the non-signing spouse may not have signed it himself/herself because the consent is implied by or inferred from the non-signing spouse’s actions or statements. [IRM 25.15.19.2.4.1 at (1) (10-23-2019)]

The IRS provides ten questions to evaluate whether tacit consent applies:

- Did the non-signing spouse have a filing requirement? Did the non-signing spouse file an MFS return? (Note that in a community property state a spouse is required to report her share of the community property, not just her income.)

- Did the non-signing spouse participate in the preparation of the return by providing return information?

- Was there a tax benefit, i.e., reduced income tax or Earned Income Tax Credit?

- Did the non-signing spouse have another reason to file jointly, i.e., divorce decree, immigration purposes, etc.?

- Did they file joint returns in prior or subsequent years?

- Did the non-signing spouse sign other tax related documents, such as in other locations on the return, forms filed after the return was filed, extension requests, and installment agreements?

- Are there any return schedules that belong to or include the non-signing spouse?

- Were there any gains or losses belonging to the non-signing spouse?

- Are there any income items on the joint return belonging solely to the non-signing spouse?

- Was the non-signing spouse a victim of domestic violence or abuse? If so, the non-signing spouse may have tacitly consented in order to avoid being abused.

Revenue Procedure 2013-34, section 2.03, states that section 6015 provides relief only from joint and several liability arising from a joint return. This also applies if the spouse signs under duress.

Revenue Procedure 2013-34 concludes, “If an individual signs a joint return under duress, the election to file jointly is not valid and there is no valid return with respect to the requesting spouse. The individual is not jointly and severally liable for any income tax liabilities arising from that return. In that case, section 6015 does not apply and is not necessary for obtaining relief. If an individual files a claim for relief under section 6015, but also maintains that there is no valid joint return due to duress, the Service will first make a determination as to the validity of the joint return and may accordingly deny the request for section 6015 relief based on the fact that no joint return was filed (and thus, relief is not necessary). If it is ultimately determined that a valid joint return was filed, the Service will then consider whether the individual would be entitled to relief from joint and several liability on the merits.”

Practice Tip: Requests for relief of a joint liability can be difficult in cases where the spouse claims an invalid joint election when he/she did not file his/her own required return. In cases where the spouse contests that he or she did not file or intend to file, he or she should take multiple avenues to declare the joint return invalid including requesting relief during an audit or CP2000 assessment, requesting a Collection Due Process hearing when available, and even using the Offer in Compromise for Doubt as to Liability. The taxpayer can also request innocent spouse relief and specifically address the elements of an invalid joint return election.

Key Terms and Definitions for Innocent Spouse Relief

The following terms are often referenced in innocent spouse issues:

| Term | Definition |

| Cincinnati Centralized Innocent Spouse Operations (CCISO) | The IRS’s centralized innocent spouse case processing unit located in Cincinnati that examines most innocent spouse claims. [IRM 25.15.8.5.3.2 (09-19-2018)] |

| Disqualified asset | A disqualified asset is any property or right to property transferred to the RS by the NRS if the principal purpose of the transfer was the avoidance of tax or payment of tax (including related additions to tax, penalties and interest). Disqualified assets include all assets transferred from the NRS to the RS during the 12-month period before, or any time after, the mailing date of the first letter of proposed deficiency (the 30-day letter). [IRM 25.15.3.8.2.6 (12-12-2016); IRC §6015(c)(4)(B)(ii)(l) and Treasury Regulation §1.6015-3(c)(3)(iii)] The presumption does not apply if the RS establishes that the transfer was pursuant to a divorce decree, separate maintenance agreement, or documents related to such a decree or agreement. |

| Injured spouse | A spouse, whose portion of a joint income tax overpayment was, or will be, offset by a federal tax debt or a Treasury Offset Program nontax debt for which he/she is not liable, is known as an “injured spouse.” A spouse may file an injured spouse claim on Form 8379, Injured Spouse Allocation, to recover part or all of a joint refund transferred to pay the separate liabilities of the other spouse. |

| Innocent spouse (IS) | Taxpayers filing joint returns may be relieved of income tax liability, plus related penalties and interest, under certain conditions as set forth in IRC §6015. |

| Joint and several liability | Under IRC §6013(d)(3), each spouse filing a joint return is jointly and severally liable for the tax. That is, each spouse is responsible for the entire income tax liability even though all or part of the liability arises from income earned by or a deduction attributable to the other spouse. |

| Jointly filed tax return | Married taxpayers may elect to file joint returns with their spouse under IRC §6013(a). An election to file a joint return may only be revoked before the due date of the return, including extensions. [Treasury Regulation §1.6013-1(d)(5)] |

| Non-requesting spouse (NRS) | The spouse or former spouse of the person who files the request for innocent spouse relief. Sometimes this person is also referred to as the “non-electing spouse.” |

| Requesting spouse (RS) | The person who files the request for innocent spouse relief (Form 8857), or otherwise properly raises the issue of innocent spouse relief. Sometimes this person is also referred to as the “electing spouse.” |

| Streamlined determination for equitable relief | Situations that would allow the IRS to ordinarily grant relief under section 6015(f) based on the RS meeting the seven requirements for equitable relief and three additional requirements based on the RS’s current marital status, economic hardship if relief is not provided, and lack of knowledge or reason to know of the understatement or underpayment. |

| Underpayment relief | Unpaid self-assessed taxes on original or amended returns. [IRM 25.15.3.9.1 (3-8-2013)] |

| Understatement relief | Additional liabilities from an error on a return (usually from an audit or underreporter deficiency assessment). [IRM 25.15.3.9.1 (3-8-2013)] |

Practice Tip: IRS Publication 971, Innocent Spouse Relief, is a very good resource for taxpayers. Taxpayers considering IS relief should reference the Publication and its examples when evaluating innocent spouse relief. In addition, there are many court decisions involving innocent spouse determinations. Taxpayers should review their circumstances against facts and existing decisions in preparing for their request. The IRS’s Internal Revenue Manual also provides a window into how the IRS will review the IS request for each type of request.

Relief for Regular Innocent Spouse: IRC §6015(b)

“Regular” or “traditional” innocent spouse relief requirements are found in IRC §6015(b).

Section 6015(b) Requirements

IRC §6015(b) provides that a requesting spouse shall be partially or fully relieved from joint and several liability, if the RS can demonstrate that:

- A joint return was filed,

- There was an understatement of tax attributable to erroneous items of income reported by the NRS,

- Upon signing the return, the RS did not know or have reason to know of the understatement,

- Taking into account all the facts and circumstances, it is inequitable to hold the RS liable, and

- The RS requested relief within two years after the IRS began collection activities.

Innocent spouse relief will not be granted if the IRS proves that the RS and NRS transferred property to one another as part of a fraudulent scheme. A fraudulent scheme includes a scheme to defraud the IRS or another third party, such as a creditor, former spouse, or business partner.

The RS is eligible for a refund under subsection (b) provided she made a payment and the requirements of IRC §6511 have been met. Generally, a taxpayer must request a refund within three years from the date his or her return was filed, or two years from the time the tax was paid, whichever occurs later, or, if no return was filed, within two years from the time the tax was paid.

No Knowledge/Reason to Know Standard

To qualify for relief, the RS cannot know or have a reason to know of the understatement. If the taxpayer actually knew about an erroneous item that belongs to the NRS, the relief does not apply to any part of the understated tax due to that item. The taxpayer remains jointly liable for that part of the understated tax. [IRS Publication 971 and IRM 25.15.3.7.3 (06-10-2024)]

A RS had actual knowledge of an erroneous item if the RS knew that an item of unreported income was received. It also applies if the RS knew of the facts that made an incorrect deduction or credit unallowable. [IRM 25.15.3.8.2.1 (06-10-2024)] With regard to a false or inflated deduction, the RS knew that the expense was not incurred, or not incurred to the extent shown on the tax return. Knowledge of the source of an erroneous item is not sufficient to establish actual knowledge. Also, the actual knowledge may not be inferred when the RS merely had a reason to know of the erroneous item. Actual knowledge of a portion of the deficiency does not invalidate the request for relief of the entire deficiency. An allocation to the NRS is invalidated for the specific items in which the RS had knowledge. [IRM 25.15.3.8.2.1 at (5) (06-10-2024)]

The RS is also not relieved if she had a reason to know about the erroneous item. This is a facts and circumstances test. The factors considered include:

- The nature of the erroneous item and the amount of the erroneous item relative to other items.

- The financial situation of the RS and NRS as well as the RS’ educational background and business experience.

- Whether the RS failed to ask, at or before the time the return was signed, about items on the return or omitted from the return that a reasonable person would question.

- Whether the erroneous item represented a departure from a recurring pattern reflected in prior years’ returns (for example, omitted income from an investment regularly reported on prior years’ returns).

[IRM 25.15.3.7.3 at (3) (06-10-2024)]

The RS is provided an exception from the no knowledge/reason to know standard if she is subject to abuse prior to the time of signing the return if the RS would fear retaliation if she did challenge any of the return items. [IRM 25.15.3.7.3 at (2) (06-10-2024, also see IRM 25.3.11.1, Alleged Abuse)]

Indications of Unfairness for Innocent Spouse Relief

The IRS will consider all of the facts and circumstances of the case in order to determine whether it is unfair to hold the RS responsible for the understated tax. The following are examples of factors the IRS will consider.

- Whether the RS received a significant benefit, either directly or indirectly, from the understated tax.

- Whether the NRS deserted the RS.

- Whether the RS and NRS are divorced or separated.

- Whether the NRS received a benefit on the return from the understated tax.

A significant benefit is any benefit in excess of normal support. Normal support depends on the particular circumstances. Evidence of a direct or indirect benefit may consist of transfers of property or rights to property, including transfers that may be received several years after the year of the understated tax.

Section 6015(b) Factors, Form 8857, and IRM References

The following table lists the factors, part on Form 8857, and IRM guidance for regular innocent spouse relief.

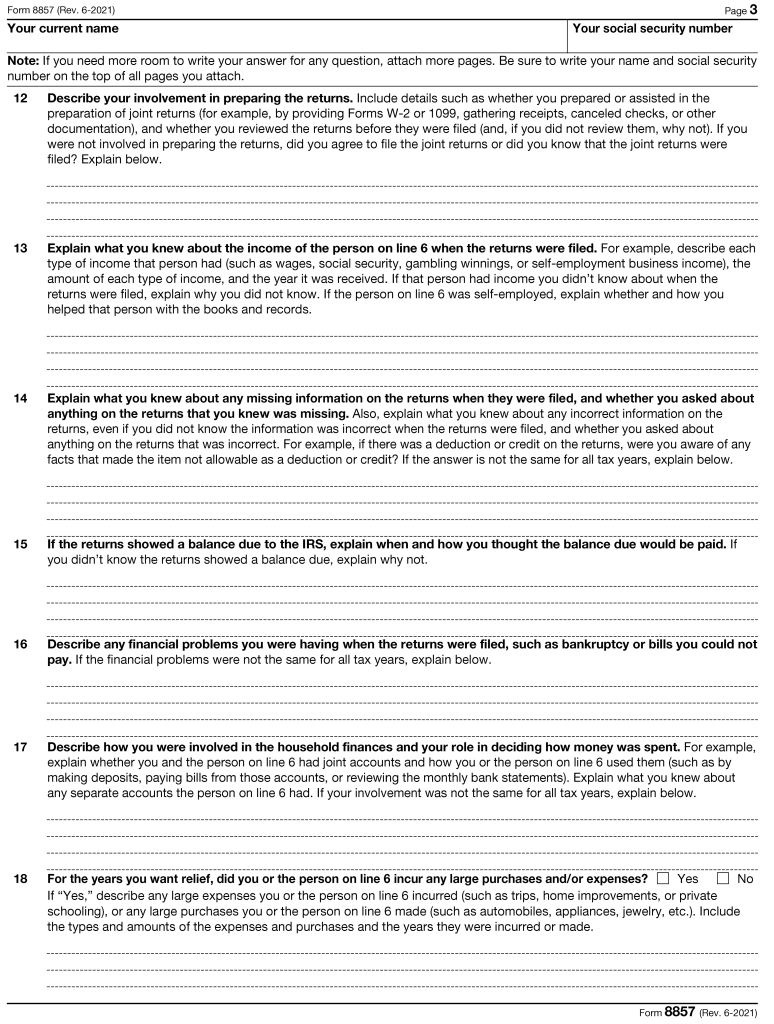

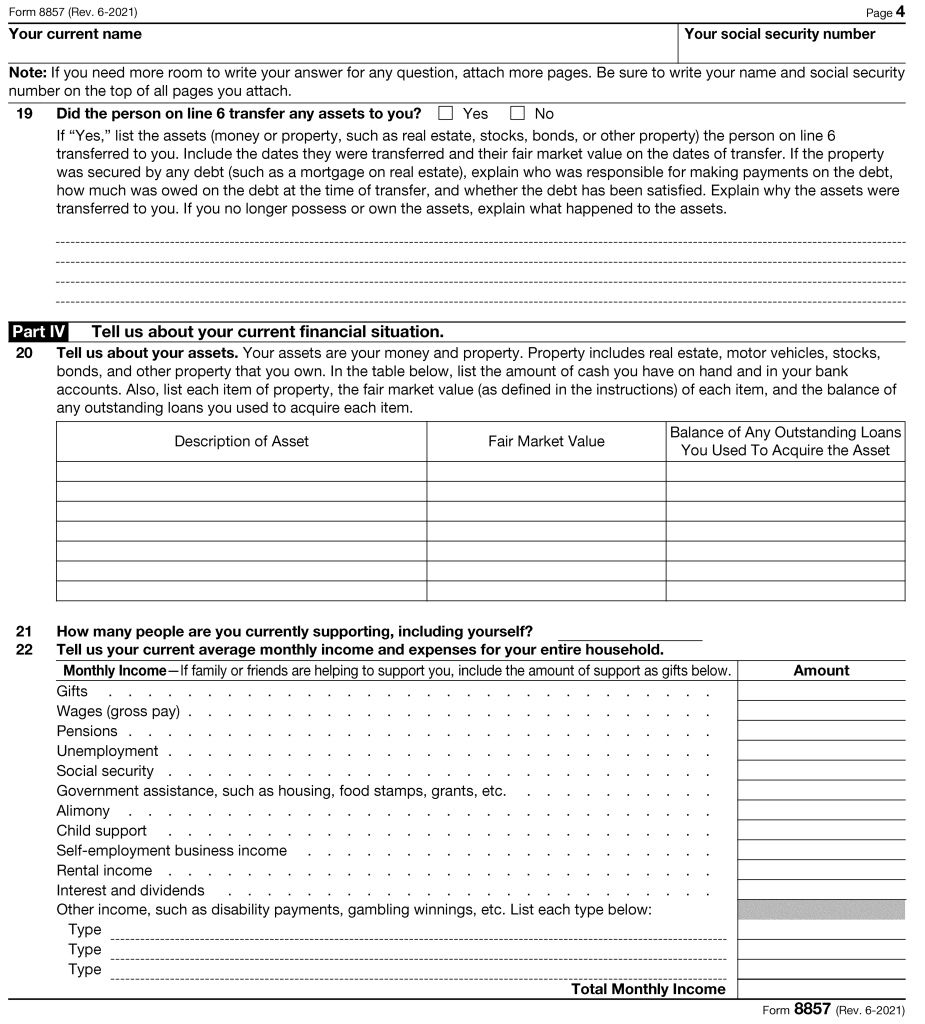

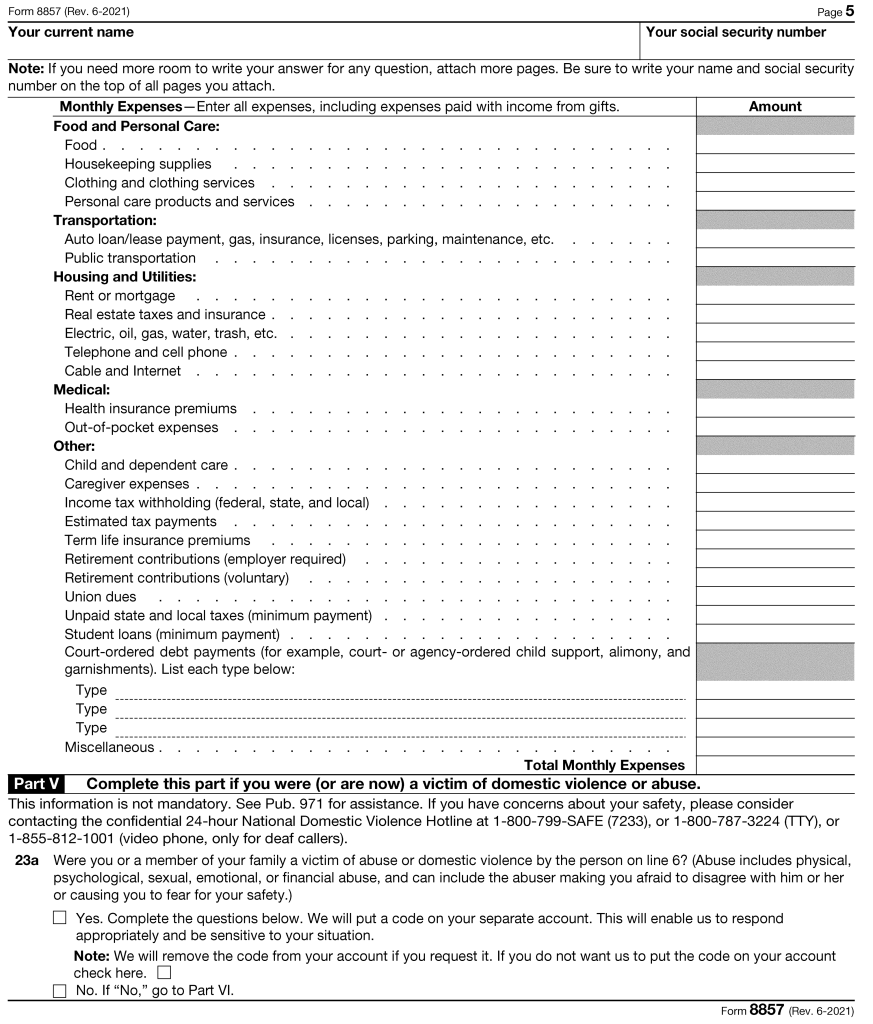

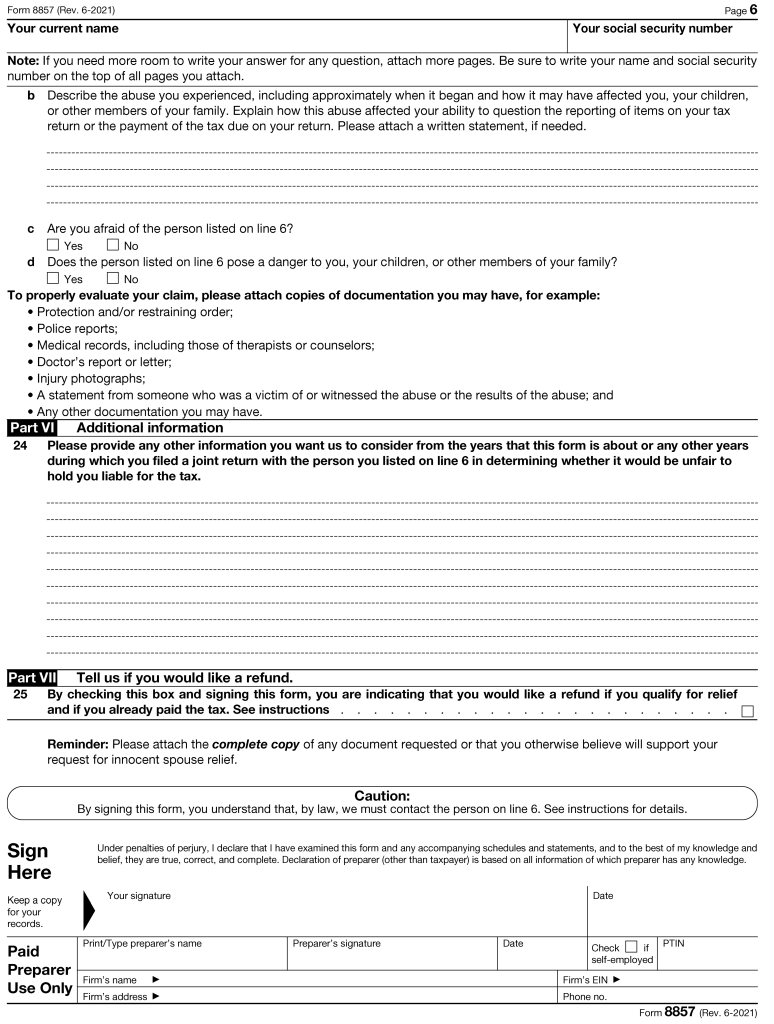

| Regular Innocent Spouse Relief — Factors, Form 8857 Questions, and IRM Guidance | |||

|---|---|---|---|

| Factor | Description | Form 8857 | IRM |

| Filed joint return | Valid joint return filed. (not a requirement for community property state RS under section 66(c)). | Part 1, Questions 1, 3 | 25.15.3.7.1 (06-10-2024) |

| Understatement attributable to NRS | Items attributable to the RS do not qualify for relief, including joint items and his or her own items. | Part 3, Questions 14-15 | 25.15.3.7.2 (12-12-2016) |

| Did not know/have reason to know about the understatement | Lack of actual or constructive knowledge. Exception: abuse of spouse prior to signing return. | Part 3, Questions 13-16 | 25.15.3.7.3 (06-10-2024) |

| Inequitable to hold RS liable | Consider all the facts and circumstances that may warrant relief. | See chart below | 25.15.3.7.4 (12-12-2016) |

| Request within two years after first collection activity | Request made within two years from the first collection activity against the RS. | Date of application | 25.15.3.7.5 (12-12-2016) and IRM 25.15.3.5.1 (12-12-2016)] |

| Inequitable to Hold RS Liable Standard — Factors, Form 8857 Questions, and IRM Guidance | |||

|---|---|---|---|

| Factor | Description | Form 8857 | IRM |

| No significant benefit | Whether the RS received significant benefit (other than normal support) from the unpaid income tax liability or item that caused the deficiency — did only the NRS benefit from living a lavish lifestyle and was it a small benefit or large benefit. | Part 3, Questions 18-19 | 25.15.3.9.4.1.5 (7-29-2014) |

| Education level | Level of education and business experience of the RS. | Part 2, Question 8 | 25.15.3.7.3 (06-10-2024) |

| Involvement in household finances | Extent of RS participation in the household finances or the activity that resulted in the erroneous item. | Part 3, Questions 12-15 | 25.15.3.7.4 at (2) (12-12-2016) |

| Desertion by NRS | NRS failure to fulfill support obligations to RS and children and /or deserted the RS/family. | Part 2, Questions 6-7 Part 3, Question 17 | 25.15.3.7.4 at (2) (12-12-16) |

| Health of RS at time of filing | Poor physical or mental health of the RS at the time of signing the return. | Part 2, Question 9 | 25.15.3.7.4 at (2) (12-12-16) |

| Economic hardship | RS would suffer economic hardship if relief is not granted. RS’s income is at 250% or below the poverty level with no assets to pay. | Part 3, Question 17 Part 4, Questions 20-22 | 25.15.3.9.4.1.2 (7-29-2014) |

| Abuse or financial control of RS by NRS | Exception to lack of actual knowledge. If RS can establish he or she was a victim of abuse prior to the time the return was signed and did not challenge any of the items on the return for fear of retaliation. | Part 2, Question 7 Part 5, Question 23 | 25.15.3.7.3 (06-10-2024) 25.15.3.7.4 at (2) (12-12-2016) |

| NRS deceitful to RS | NRS concealment of financial affairs from RS. | 25.15.3.7.4 at (2) (12-12-2016) | |

| RS received tax benefit on the return from the understatement | An erroneous item does not qualify to the extent the RS received a tax benefit from that item on the original return (i.e., deductions, credits, losses, etc. that offset RS’ income). | Filed tax returns and Part 3, Questions 12-16 | 25.15.3.8.2.7 (12-12-2016) |

Relief for Separation of Liability: IRC §6015(c)

IRC §6015(c) is referred to as the “election to allocate a deficiency.” [IRM 25.15.3.8 (12-12-2016)] If a RS is denied relief for all or part of the deficiency under section 6015(b), the RS can consider relief under section 6015(c) for the portion denied under section 6015(b). In fact, both parties to a joint return may elect to allocate a deficiency. However, if only one spouse requests allocation, the NRS will still be liable for the entire deficiency. [IRM 25.15.3.8 at (2) (12-12-2016)]

Allocation is determined by attributing each item adjusted to one or both spouses. Items which are attributed to both spouses are allocated 50% to each spouse. The allocation cannot produce a refund as refunds are not allowed under section 6015(c).

Section 6015(c) Requirements

To obtain relief under this section, the requesting spouse must demonstrate that:

- A joint return was filed,

- There is a deficiency attributable to the NRS’ erroneous items, (the RS may also be relieved from the portion of the tax liability resulting from a joint item adjustment)

- At the time relief was requested, the joint filers were unmarried, legally separated, widowed, or had not lived in the same household for the 12 months immediately preceding the election, and

- The election was made within two years after the IRS began collection activities against the requesting spouse.

A taxpayer is ineligible for relief under IRC §6015(c) if the IRS demonstrates that, at the time he or she signed the return, the taxpayer requesting relief had “actual knowledge” of any item giving rise to the deficiency. [IRC §6015(c)(3)(C)] The relief provision under section 6015(b) denies relief if the RS also has constructive knowledge (i.e., reason to know) of certain items. However, the RS may qualify for relief under section 6015(c) if the RS did not have actual knowledge of those items.

The actual knowledge factors for section 6015(c) are similar to the standard in section 6015(b) relief. There is an exception to the actual knowledge for a RS that is subject to abuse or domestic violence.

Transfers of Property and Fraud

Similar to the requirements in section 6015(f) (equitable relief), relief is also unavailable for amounts attributable to fraud or fraudulent schemes. [IRM 25.15.3.8.2.2 (12-12-2016)]

Relief is also not available to the extent of the value of disqualified assets transferred to the RS by the NRS if the principal purpose was to avoid the tax or payment of tax. All assets transferred from the NRS to the RS during the 12-month period before, or any time after, the first letter of proposed deficiency are presumed to be disqualified assets. However, the presumption does not apply if the transfer was due to a divorce decree or a separate maintenance agreement. The RS can attempt to rebut the presumption by establishing that the purpose of the transfer was not the avoidance of tax. [IRM 25.15.3.8.2.6 (12-12-2016)]

Allocating a Deficiency

An erroneous item that would otherwise qualify for relief does not qualify to the extent the RS received a tax benefit from that item on the original return. IRC §6015(d) provides the procedures to allocate a deficiency.

As indicated below, IRM 25.15.3.8.3.1 (12-12-2016) provides the IRS’s seven steps to allocate a deficiency between the joint return and the NRS individually.

| Step | Action |

| 1 | Determine the total deficiency for the joint return with all adjustments. Note: For example, this amount should reconcile with Line 14, Deficiency-Increase in Tax, of Form 4549, Income Tax Examination Changes. |

| 2 | Identify and allocate separate treatment items. See IRM 25.15.3.8.3.2, Separate Treatment Items, for more information. |

| 3 | Compute the total allocable deficiency. This is done in order to allocate income tax before the application of credits and other taxes. Therefore, certain disallowed credit items are subtracted from the total deficiency. Other tax increases, such as self-employment tax, are also subtracted from the total deficiency. When applicable, credit items increased, and other taxes decreased are added back to the total deficiency. Joint deficiency (Step 1) -/+ Separate treatment items (Step 2) = Total Allocable Deficiency (Step 3) |

| 4 | Allocate all adjustment items between the spouses. The allocation takes into account exceptions and special rules as follows: • Actual knowledge bars relief for the item. See IRM 25.15.3.8.2.1. • Fraudulent transfers invalidate request for relief. See IRM 25.15.3.8.2.2. • RS bears burden of proof for establishing the portion of deficiency allocated to them. See IRM 25.15.3.8.2.3. • Allocate items to joint liability or NRS individual liability according to attribution. • Tax benefit limitation may apply. See IRM 25.15.3.8.2.7. • When an understatement is due to fraud. See IRM 25.15.3.8.2.5. • There is no relief for items attributable to RS – they are not allocated to NRS liability. See IRM 25.15.3.8.2.4. Note: A RS can obtain relief from his or her own item to the extent that the RS does not receive a tax benefit from the item and the item offsets the NRS’s income. In these instances, the Service must establish that the RS had actual knowledge to invalidate the allocation to the NRS or the RS will be able to obtain relief. • Disqualified Asset transfers. See IRM 25.15.3.8.2.6. • Household Employment Taxes. See IRM 25.15.3.8.2.8. • Child’s Liability. See IRM 25.15.3.8.2.9. |

| 5 | Compute the allocable deficiency ratio for the joint and NRS individual liabilities. This is the portion of the total allocable deficiency (Step 3) allocated to NRS and the joint liability, using the ratio of the adjustment items allocable to each (Step 4) over the total of all allocated adjustment items. Percentage of adjustments allocated (Step 4) × Total allocable deficiency (Step 3) = Percentage of Deficiency Allocated (Step 6) |

| 6 | Compute the total deficiency allocated to the NRS individually and the joint account liability. This is a two-step process: • The allocable deficiency is adjusted for the Separate Treatment Items [See IRM 25.15.3.8.3.2, Separate Treatment Items] added or removed from the total deficiency in Step 3. The result is the Tentative Total Deficiency allocated to the NRS individually and the joint liability. Deficiency allocated (Step 5) +/- Separate treatment tax items (Step 3) = Tentative total deficiency allocated Note: The total of the joint liability plus NRS’s allocated individual liability should equal the total deficiency before any allocation — the amount in Step 1 |

| 7 | Compute and adjust for any change to the Earned Income Credit (EIC). • Compute the allocation of the EIC based on attribution of items increasing AGI unless it was adjusted due to other reasons. If adjusted due to other reasons, the allocation is based on attribution of the adjustment. Tentative total deficiency as allocated + The decrease in EIC – The increase in EIC = Total Deficiency Allocated |

Section 6015(c) Factors, Form 8857, and IRM References

The following table lists the factors, part on Form 8857, and IRM guidance for relief for separation of liability.

| Relief for Separation of Liability — Factors, Form 8857 Questions, and IRM Guidance | |||

|---|---|---|---|

| Factor | Description | Form 8857 | IRM |

| Filed joint return | Valid joint return filed. (not a requirement for community property state RS under section 66(c)) | Part 1, Questions 1, 3 | 25.15.3.8.1 at (1a) (12-12-2016) |

| Understatement attributable to NRS | Items attributable to the RS do not qualify for relief, including joint items and his or her own items. | Part 3, Questions 13-14 | 25.15.3.8.1 at (1b) (12-12-2016) |

| RS divorced, widowed, or legally separated from NRS – or RS and NRS were not members of the same household for 12 months prior to request | RS and NRS are effectively apart. | Part 2, Question 7 | 25.15.3.8.1 at (1c) (12-12-2016) |

| Request within two years after first collection activity | Request made within two years from the first collection activity against the RS. | Date of application | 25.15.3.8.1 at (1d) (12-12-2016) |

| Actual knowledge invalidates allocation | RS actual knowledge of items giving rise to understatement cannot be allocated to NRS. Exception: abuse or domestic violence of spouse prior to signing return. | Part 3, Questions 12-15 Part 5, Question 23 for exception | 25.15.3.8.2.1 (06-10-2024) |

| No fraud | Fraud by one or both spouses can change allocation based on facts and circumstances. | Part 3, Questions 13, 14, 19 | 25.15.3.8.2.5 (12-12-2016) |

| No fraudulent schemes | No relief if assets were transferred as part of fraudulent scheme. | Part 3, Questions 14, 15, 19 | 25.15.3.8.2.2 (12-12-2016) |

| No transfer of disqualified assets | No relief if NRS transfers a “disqualified asset” to the RS for purpose of avoiding tax. | Part 3, Questions 14, 15, 19 | 25.15.3.8.2.6 (12-26-2016) |

Equitable Relief: IRC §6015(f)

IRC §6015(f) provides relief from joint and several liability where, taking into consideration all the facts and circumstances, it is inequitable to hold the spouse liable for an understatement or underpayment when relief under sections 6015(b) and (c) do not apply.

Revenue Procedure 2013-34 provides extensive guidance for all innocent spouse claims under 6015(f) filed after September 13, 2013. Section 6015(f) is the only innocent spouse provision that provides relief from underpayment.

Section 6015(f) Requirements

There are seven requirements for equitable relief:

- The RS is not eligible for innocent spouse relief or separation of liability relief.

- The RS filed a joint return for the tax year(s) at issue.

- The request was timely filed.

- The RS and NRS did not transfer assets to one another as a part of a fraudulent scheme. A fraudulent scheme includes a scheme to defraud the IRS or another third party, such as a creditor, former spouse, or business partner.

- The NRS did not transfer property to the RS for the main purpose of avoiding tax or the payment of tax.

- The RS did not knowingly participate in the filing of a fraudulent joint return.

- The income tax liability is attributable (either in full or in part) to an item of the NRS or an unpaid tax resulting from the NRS’s income. If the liability is partially attributable to the RS, then relief can only be considered for the part of the liability attributable to the NRS.

[IRM 25.15.3.9.2.1 (06-10-2024)]

Liability Attributable to NRS Exceptions

The IRS will consider granting relief regardless of whether the understated tax, deficiency, or unpaid tax is attributable (in full or in part) to the RS if any of the following exceptions apply. [Publication 971 and IRM 25.15.3.9.2.1 at (7a-e) (06-10-2024)]

- Attribution solely due to the operation of community property law: the item is attributable or partially attributable to the RS solely due to the operation of community property law. If you meet this exception, that item will be considered attributable to the NRS for purposes of equitable relief. (Requirements #1 and #2 do not apply)

- Nominal ownership: if the item is titled in the name of the RS, the item is presumed to be attributable to the RS. However, the RS can rebut this presumption based on the facts and circumstances.

- Misappropriation of funds: the RS did not know, and had no reason to know, that funds intended for the payment of tax were misappropriated by the NRS for their benefit. The IRS will consider granting equitable relief only to the extent the funds intended for payment were taken by the NRS.

- Abuse not amounting to duress: the RS establishes that he/she were the victim of spousal abuse or domestic violence before the return was filed, and that, as a result of the prior abuse, the RS did not challenge the treatment of any items on the return for fear of the NRS retaliation. If the RS meets this exception, relief will be considered even though the understated tax or unpaid tax may be attributable in part or in full to the RS’s item.

- NRS fraud: if the RS establishes that the NRS’s fraud is the reason for the erroneous item, the IRS will consider equitable relief.

Streamlined Determinations for Equitable Relief