Chapter 7- Trust Fund Recovery Penalty

Chapter 7

Trust Fund Recovery Penalty

INTRODUCTION

| If you want to: | |

| Understand the implications for an employer that does not pay their payroll taxes and the basic concepts of the Trust Fund Recovery Penalty (TFRP). | |

| Understand key terms used in payroll tax collection and assessment of the Trust Fund Recovery Penalty. | |

| Navigate the seven steps of the TFRP investigation process, including the IRS TFRP investigation process, the appeals process and options, and the collection of the assessed TFRP. | |

| Determine who is a responsible person, and how the IRS interprets responsible and willful in asserting the TFRP. | |

| Identify and use resources that help with TFRP investigations including the IRS Internal Revenue Manual, Forms, Publications, Notices, web pages and phone numbers. | |

| Use and review common forms, letters, publications, and templates for the TFRP. |

Key Highlights:

- Employers with unpaid payroll taxes are a serious compliance concern for the IRS. Persons who are responsible to collect and pay payroll taxes for a company and willfully do not do so can be held personally responsible for payment of the unpaid trust fund tax portion (Social Security, Medicare, and income taxes withheld from an employee) of the liability. This assessment is called the “trust fund recovery penalty” or “TFRP.”

- Most single owner small businesses will concede to the TFRP because the owner/operator will be considered a responsible person. The owner will be responsible for payment of the trust fund taxes and will need to make arrangements (IRS collection alternatives) to pay the tax. When there are multiple persons assessed the TFRP, the IRS will attempt to assess and collect from any or all these persons. The IRS has no obligation to collect equitably from the responsible persons, and often do not do so.

- Payroll tax delinquencies are investigated by local IRS collection by revenue officers. The revenue officer will conduct the entire TFRP investigation, including investigating the business, the responsible persons, and the ultimate collection of the assessed TFRP from all involved. The responsible person will have multiple options to appeal an adverse TFRP determination.

- The determination criteria for who is a responsible person are “responsibility” and “willfulness” — both have to be met to assess the TFRP against a person. This determination is often the most contested issue in payroll tax cases. Taxpayers and their representatives should always research current case law in determining whether the person is a responsible person for the TFRP.

- In TFRP and payroll tax delinquency investigations, taxpayers should always get professional representation. The IRS views responsible persons who do not pay collected employees’ trust fund taxes as potential criminals. Also, the TFRP process can be complicated and should be left to competent professional representation to obtain the best outcome.

What’s New for 2025?

- IRS continues field enforcement of payroll tax collection: the IRS has prioritized collection of delinquent payroll taxes through its Collection Field function. Additional IRS field collection resources have also allowed more revenue officers to conduct both Federal Tax Deposit alert inquiries and TFRP investigations.

- IRS announces a policy change that ends mostrestricts unannounced visits to taxpayers by revenue officers: The policy change, announced on July 23, 2023, was enacted to reduce public confusion and enhance safety measures for its employees and taxpayers. [IR-2023-133 (July 24, 2023)]

What’s Covered in This Section?

- What is the trust fund recovery penalty.

- Who can be assessed the trust fund recovery penalty (i.e., a “responsible person”).

- How a trust fund recovery penalty determination is made.

- The trust fund recovery penalty investigation and appeals process.

- Collection decisions for business and the responsible persons who are liable for the TFRP.

What’s Not Covered — and Why?

- Criminal investigations of willful failure to collect and remit trust fund taxes: responsible persons who are pursued criminally by the IRS should obtain legal counsel. In many cases, these situations involve taxpayers who have repeatedly withheld and not paid employment taxes to the IRS.

- “Responsible” and “willful” case research: this section highlights many of the important IRS citations for TFRP determinations. However, taxpayers/representatives should conduct research on the many existing and recent cases that support their position and contest any adverse TFRP determination.

- Bankruptcy options: use of bankruptcy is usually not a viable option for IRS collection issues for responsible persons. However, taxpayers should always seek legal counsel to request bankruptcy advice.

Most Common Taxpayer and Tax Professional Actions Performed When Addressing Delinquent Payroll and Trust Fund Recovery Penalty Issues

- Researching business payroll debt amounts and evaluating who is potentially responsible for the unpaid payroll taxes.

- Preparing for the trust fund recovery penalty (Form 4180) interview, including summarizing testimony and obtaining requested documents for analysis and for the IRS.

- Researching and evaluating whether a taxpayer meets the responsible and willful requirements for TFRP assessment and contesting the determination.

- Requesting and setting up collection agreements for the business and the responsible person(s).

When to Get an Expert Involved

- All trust fund recovery investigations: TFRP investigations are complicated and can have severe consequences. Taxpayers should always get qualified representation in all trust fund investigations.

- Appeals of TFRP determinations: TFRP appeals options and process can be especially complicated. Taxpayers requesting an appeal should consult an expert who can explain options, and better present the facts and legal argument for relief.

- Pyramiding taxpayers: taxpayer should always involve a qualified attorney when the taxpayer has multiple instances of late, unpaid payroll tax noncompliance and/or there are indications of fraud.

Professional Assistance Fees

- TFRP representation – hourly: ranges from $80-$700 an hour for an EA, CPA, or tax attorney to represent the taxpayer in a TFRP.

- Flat fee: National firms can charge flat fees from $5,000+ depending on other issues present, number of years involved, and amount in question. Generally, the national firm will include collection agreement representation as part of this service.

- Generally, taxpayers cannot obtain free assistance from the IRS or Low-Income Taxpayer Clinics in business collection or TFRP matters.

Closely Related Issues

- Collection: both the business and TFRP assessed individual(s) will face IRS collection issues during the TFRP. Evaluating ability to pay options and obtaining a collection agreement will be part of the payroll tax investigation.

Time to Complete Estimates for Common TFRP Actions

| TFRP Action | Estimated Hours to Complete | Average Duration Estimate |

| Obtaining tax history and transcripts from the IRS to evaluate unpaid payroll taxes and trust fund amounts | <2 hours (best to call IRS by phone) | One day-three weeks (if transcripts come by mail) |

| Preparing for the trust fund recovery penalty interview, and obtaining relevant documents requested by the IRS/support the TFRP assertions | 4-24 hours; shorter if agreeing to the TFRP | Usually given 2-4 weeks by the IRS before the TFRP interview |

| Responding to and arguing the TFRP assessment | 4-15 hours, depending on the facts and circumstances | If the determination is contested, this process can take up to 9-12 months |

| Appeal adverse TFRP determination | 10-15 hours | IRS appeals can take four months to a year for a determination. Appeal to the courts can take years. |

| Obtaining a collection alternative on a TFRP assessment | 4-15 hours, depending on the collection alternative selected | One-six months; longer if an offer in compromise is requested |

THE TRUST FUND RECOVERY PENALTY

This section provides an overview of the unpaid payroll tax enforcement and the trust fund recovery penalty process.

| Topic | Covers | |

| Overview of Payroll Tax Responsibilities and the Trust Fund Recovery Penalty | Information on a business’s payroll tax obligations, IRS employment tax enforcement programs, the trust fund recovery penalty, and obtaining professional representation for the TFRP investigation. | |

| Key Terms and Definitions | Common terms and definitions used in payroll tax delinquency cases and Trust Fund Recovery Penalty investigations. | |

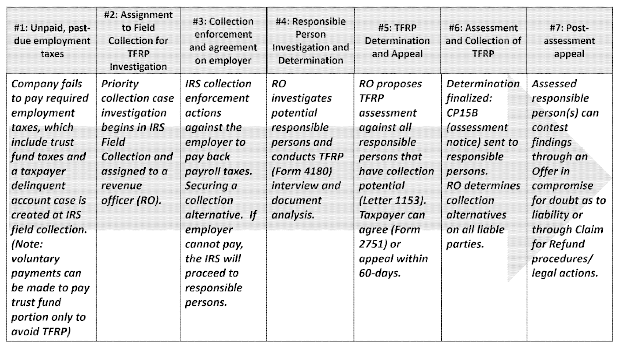

| Trust Fund Recovery Penalty (TFRP) Investigation Process | The seven steps of the TFRP investigation process: • Step #1: Unpaid, past-due employment taxes • Step #2: Assignment to Field Collection for TFRP Investigation • Step #3: Collection enforcement and agreement on employer • Step #4: Responsible Person Investigation and Determination • Step #5: TFRP Determination and Appeal • Step #6: Assessment and Collection of TFRP • Step #7: Post-assessment appeal | |

| Responsible Person Determination Criteria | The rules on determining if a person is a responsible person, including the responsibility and willfulness determination elements. | |

| Additional Assistance with TFRP Investigations | Trust Fund Recovery Penalty assistance from IRM sections, forms, publications, notices, web links, and frequently used phone numbers. | |

| Resources | Important forms, letters, publications, and templates used in the TFRP investigation process. |

Other helpful sections:

| Topic | Covers | |

| Evaluating Collection Alternatives | Obtaining a collection alternative for outstanding federal tax debt. |

Key Highlights:

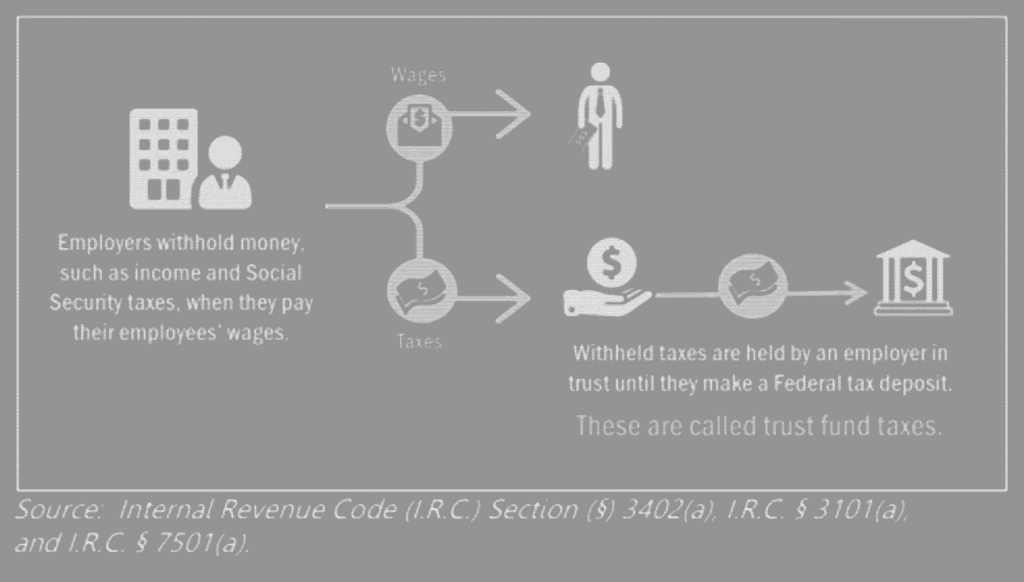

- Employers are responsible for withholding income, Social Security, and Medicare taxes from their employees. The employer is also responsible for payment of these withheld taxes to the IRS. The amounts withheld from the employee are called “trust fund taxes.”

- Employers with unpaid payroll taxes are a serious compliance concern for the IRS. Congress has provided the ability for the IRS to assess and collect the trust fund taxes to any and all of the employer’s “responsible persons.” This assessment is called the “trust fund recovery penalty” or “TFRP.”

- A “responsible person” is any person who is responsible to account for, collect, and pay trust fund taxes to the government and willfully fails to do so. Who is a “responsible person” is a facts and circumstances determination and is the most contested issue in a TFRP investigation.

- Unpaid payroll tax issues and TFRP investigations are enforced by the Collection Field function (CFf or “local IRS collection”). IRS revenue officers conduct the investigation, interview the responsible persons, analyze collection information on the employer and company principals/employees to determine their ability to pay, and propose TFRP on those individuals that they deem as “responsible persons.” Proposed TFRP assessments can be appealed before assessment.

- Once the TFRP is assessed, the IRS will proceed to collect on any or all of the persons assessed. During this time, the IRS will also attempt to collect the past-due employment taxes owed from the business.

Overview of Payroll Tax Responsibilities and the Trust Fund Recovery Penalty

As of 20210, there were over 8.1 million employers in the United States. [U.S. Census Bureau, Small Business Saturday (Nov. 26, 2022)]Number of Employer Establishments by NAICS Sector: 2021 9April 27, 2023)] These employers have a federal payroll tax filing and payment obligation. Employers are required to withhold from their employees’ salaries amounts for individual federal income taxes and for Federal Insurance Contribution Act (FICA) taxes, which includes Old-Age, Survivors and Disability Insurance (Social Security) and Hospital Insurance (Medicare) taxes. In 20254, the FICA taxes to be withheld consisted of 6.2% of an employee’s gross salary up to $176,100168,600 for Social Security taxes and an additional 1.45% of the gross salary for hospital insurance.

Employers are also required to match the amounts withheld from an employee’s salary for Social Security and Medicare taxes.

The combination of the amounts withheld from an employee’s salary and the employer’s portion of the taxes comprise the business’s payroll taxes:

- Employer taxes (non-trust fund taxes): the employer pays Social Security, Medicare, and Federal Unemployment (FUTA) taxes.

- Employee taxes (trust fund taxes): the employee-withheld amounts of FICA and Medicare taxes, and employer-withheld federal income taxes (FITW) (withheld from the employee’s pay).

The employer is responsible for paying all of these taxes to the IRS via regular tax deposits (called “federal tax deposits” or “FTD”). The employer also files quarterly employment tax returns, Form 941, Employer’s QUARTERLY Federal Tax Return, to report wages and associated payroll taxes.

Practice Tip: Many employers outsource payroll to a payroll service provider (PSP) who handles employee paychecks as well as the employer’s federal tax deposits and tax filing obligations. Taxpayers need to be aware that outsourcing to these providers does not relieve the taxpayer of their obligations to file and pay on time. In most cases, the employer will be responsible for any and all payroll taxes due. However, employers can limit their liability by using a Certified Professional Employer Organization (CPEO). For more on CPEOs, go to https://www.irs.gov/tax-professionals/about-certified-professional-employer-organization. For a list of CPEOs, go to https://www.irs.gov/tax-professionals/cpeo-public-listings

Trust Fund Taxes

The employee’s portion of the payroll taxes withheld are called “trust fund taxes” as the employer has collected or withheld taxes from another person and held them in trust to be paid to the IRS. The employer’s taxes are not trust fund taxes.

[TIGTA Report 2020-10-042, Existing Controls Did Not Prevent Unauthorized Disclosures and Case Documentation Issues in Appeals Trust Fund Recovery Penalty Cases (Aug. 12, 2020)]

For example, a taxpayer is paid $200 in wages in which there is $15.30 in employer FICA taxes, $15.30 in employee’s withheld FICA taxes, and $30 in withheld federal income taxes (FITW). The employer portion is $15.30 and are not trust fund taxes. The employee withheld amounts, FICA of $15.30 and FITW of $30, or $45.30, constitute the trust fund portion of the payroll taxes. [[IRM 5.17.7.2.6 (08-01-2010)]]

IRS Employment Tax Enforcement Compliance Programs

Employers who do not pay their employment taxes to the IRS face IRS scrutiny by the IRS collection function.

The IRS has several programs related to employment tax enforcement:

• Federal Tax Deposit (FTD) Alerts: pre-emptive contacts by IRS collection personnel on identified potentially delinquent employers.

• IRS Collection on employers: the IRS can enforce collection on the delinquent employer through liens and levies. Employers can also enter into payment agreements with IRS collection on back amounts owed. However, unless the amount owed is $25,000 or less on the current or prior calendar year, and can be paid in 24 months or less by the employer (called an “in-business trust fund express installment agreement” or “IBTFIA”), the IRS is likely to pursue payment from the “responsible persons” of the business/employer. [[IRM 5.14.5.4 (10-14-2021)]]

• IRS Collection actions on “responsible persons”: local IRS field collection investigation, assessment, and collection of the trust fund portion of the payroll taxes on the business/employer’s owners and those responsible and willful in failing to pay over the taxes (“responsible person(s)”). [[IRS Policy Statement 5-14 (06-09-2003)]]

Federal Tax Deposit (FTD) Alerts

FTD Alerts are issued on taxpayers who are classified as semiweekly depositors and who have not made FTDs during the current quarter or who have made them in substantially reduced amounts. [[IRM 5.7.1.2 (05-10-2017)]] The IRS prioritizes employers who have had previous notices for unpaid liabilities in prior two quarters (called a potential employment tax “pyramider”). The IRS also uses business rules to identify potential employers who will owe (called a potential “non-compliant” employer) and employers who are at risk for late employment tax deposits (called a potential “at-risk” employer). [[IRM 5.7.1.2 (05-10-2017)]]

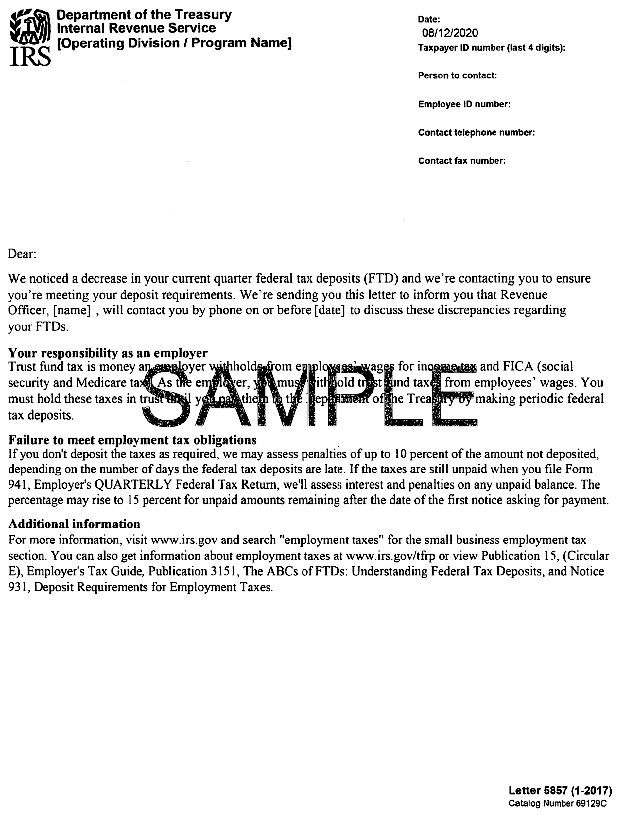

FTD alert contacts are made by local IRS Collection Field function (CFf). [IRM 5.7.1.4 (02-21-2020)] Revenue officers (RO) are IRS employees who locally enforce the collection of back taxes on the most serious IRS collection cases, including all employment tax noncompliance issues. The RO assesses the potential noncompliance of the employer and contacts the employer (or authorized power-of-attorney, if applicable) within 15 days of assignment to inquire about the potential employment tax noncompliance. The RO can contact the taxpayer in person or by phone. Prior to trying to contact a FTD Alert taxpayer by telephone, the RO may issue Letter 5857, FTD Alert Telephone Contact Letter, to the taxpayer’s address on record to inform them that the RO will call the taxpayer by the specified date entered on the letter. If the RO visits the employer in person and is unable to reach the sole proprietor, partner, or a corporate officer who has authority to bind the partnership or the corporation, the RO will leave IRS Letter 5664, FTD Alert Field Contact Letter, to inform the employer of the purpose of the visit. [IRM 5.7.1.6 (02-21-2020)]

The RO will work with the employer to understand any noncompliance issues. The RO will not close the FTD Alert until the employer is brought into full compliance — including filing all required tax returns, making appropriate tax deposits in the proper amount, and paying any tax due with the return at the time the return is filed. If the taxpayer is not in compliance (i.e., there is a balance due and/or has an unfiled return), the case is assigned to the RO for enforced collection. [[IRM 5.7.1.9 (02-21-2020)]] At that time, the business taxpayer can be subject to enforced collection (i.e., lien and/or levy). The business will start to work with the RO to set up a collection alternative (installment agreement, not collectible status, or an offer in compromise) to avoid enforced collection actions.

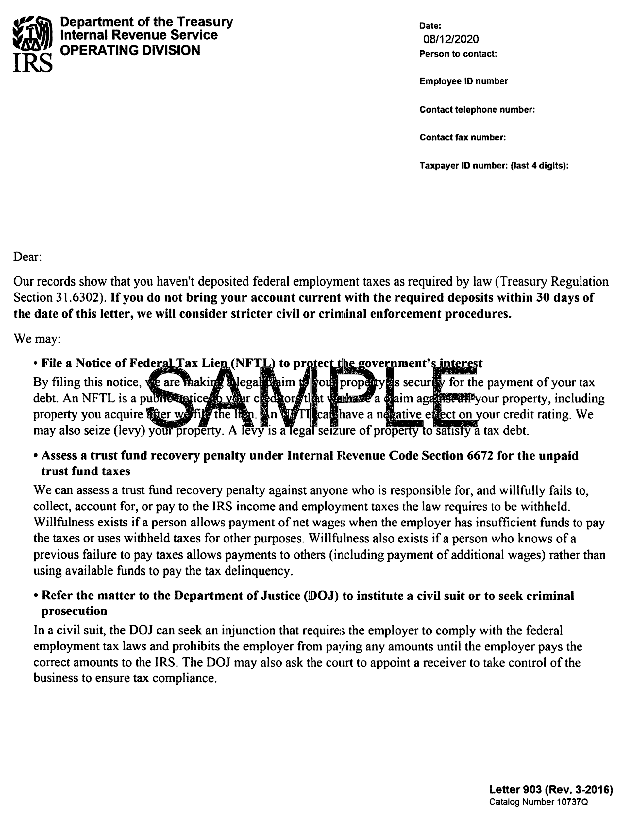

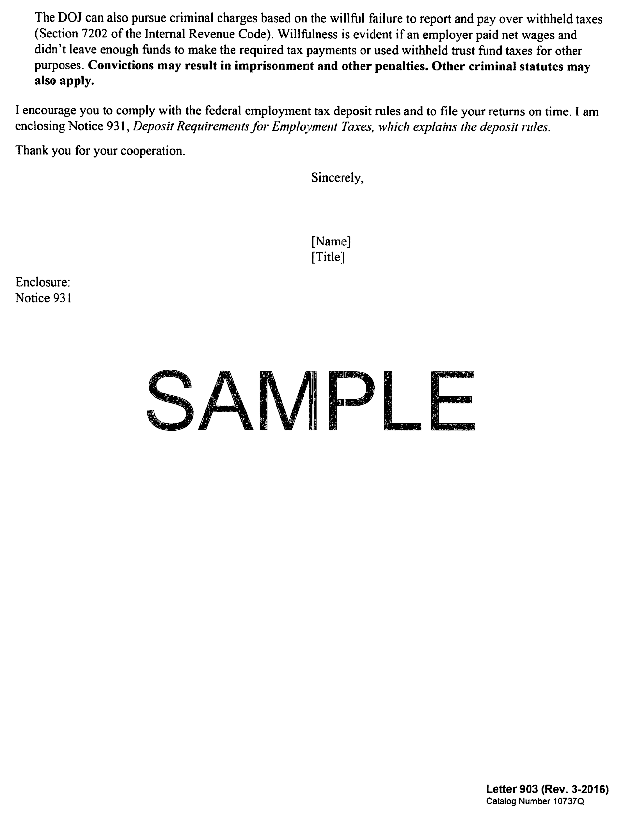

In egregious cases of employer noncompliance, such as pyramiding of employment taxes, the RO can issue Letter 903, You Haven’t Deposited Federal Employment Taxes (FTD Alert), to alert taxpayers to the provisions of IRC §7402(a), which provides the federal district court with the jurisdiction to pursue civil injunctions to stop the pyramiding of payroll taxes. [[IRM 5.7.2.1.1 (02-08-2021)]]

Practice Tip: Pyramiding of payroll taxes is defined as an in-business taxpayer who is not current on their FTD and has two or more unresolved quarters assigned to IRS Collection Field function (CFf). [[IRM 5.7.8.4 (03-09-2017)]] Letter 903 indicates that the IRS considers the employer and its responsible persons to be seriously noncompliant. Often the IRS will consider criminal penalties in cases where Letter 903 is issued, and the taxpayer has a history of repeated payroll tax noncompliance. Taxpayers who receive Letter 903 with past history of noncompliance should consider hiring a tax attorney to represent them before the IRS.

IRS Collection on Employers

When an employer owes back payroll taxes, the IRS will attempt to collect these taxes through a series of notices. The business can pay the balance owed or enter into an agreement on the outstanding balances (installment agreement, not collectible, offer in compromise) to return to good standing with the IRS.

The IRS will generally want the business to exhaust all available assets to pay the back employment taxes. However, if the business/employer cannot pay the balance quickly, the IRS will likely pursue collection from both the business/employer and all responsible persons.

Practice Tip: Generally, the IRS will not pursue responsible persons if the business/employer owes $25,000 or less and quickly sets up a payment plan with the IRS to pay the balance in full within 24 months (called an “in-business trust fund express installment agreement” or “IBTFIA”) [[IRM 5.14.5.4 (10-14-2021)]] However, if the business/employer cannot pay on the IBTFIA express agreement or if the balance owed is greater than $25,000 and involves an earlier year other than the current and prior calendar year, the case will proceed to IRS field collection for enforcement against the business and its responsible persons.

If the balance is unresolved (not fully paid on in an IBTFIA), the business/employer’s unpaid account will be routed to the IRS Collection Field function for local IRS enforcement on the business and its responsible person(s).

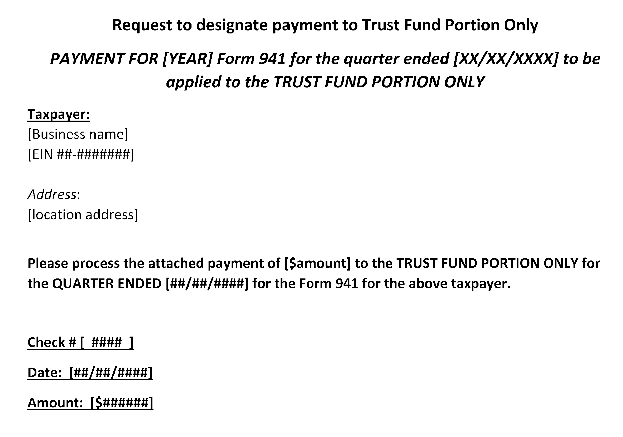

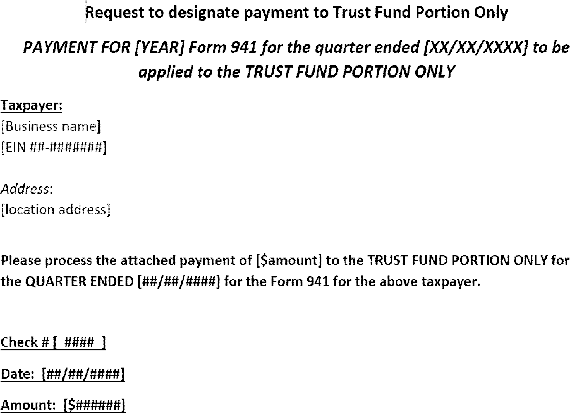

Practice Tip: The business and/or its responsible persons can make voluntary, designated payments to the “trust fund portion only” to preemptively remove the need for responsible person investigations. The payments must be carefully designated, by quarter, to the trust fund balance only. The business/employer should contact the IRS and get the exact amounts of the trust fund portion for each quarter and designate payments, with separate checks, to each quarter. The business/employer will need to specifically state (in the memo section of each check) that the payment should be designated to the trust fund portion only. The business’s name, EIN, and payroll quarter should also be included in the memo section of the check. The business/employer should also include a letter instructing the IRS to designate the payment to the trust fund portion only for the specific quarter. See ¶701.06 for a template letter to attach to each check in order to have the IRS properly designate the payment.

The Trust Fund Recovery Penalty

If a business fails to pay the trust fund amounts withheld from employees, the IRS may pursue both the employer — and the person(s) responsible (i.e., “responsible person(s)”) for accounting for, collecting, and paying the trust fund taxes.

In order to hold the person liable for the taxes, the IRS must show that the person is a “responsible person” within the meaning of IRC §6672. The person(s) who is held responsible for the non-payment of the trust fund taxes is assessed the “trust fund recovery penalty” or “TFRP” (also referred to as the “100% penalty” referring to owing 100% of the outstanding trust fund taxes). The IRS can collect the total liability (both the employer liability and the trust fund liability) from the employer and the trust fund portion from the responsible person(s).

Practice Tip: Trust fund taxes include more than just withheld employment taxes from employees. They also include many types of taxes that are collected and held in trust such as many excise taxes (Form 720), partnership withholding tax (Form 8804), and withholding on U.S. sourced income for foreign persons (Form 1042). [IRM 5.7.3.1.1 (7-24-2023)] For purposes of this section, we will focus on the most common trust fund issue — employment taxes.

Congress provides the IRS the authority to collect trust fund taxes from those who are determined to be “responsible persons.”

IRC §6672(a) provides for the TFRP:

Any person required to collect, truthfully account for, and pay over any tax imposed by this title who willfully fails to collect such tax, or truthfully account for and pay over such tax, or willfully attempts in any manner to evade or defeat any such tax or the payment thereof, shall, in addition to other penalties provided by law, be liable to a penalty equal to the total amount of the tax evaded, or not collected, or not accounted for and paid over.

In order to hold the “responsible person(s)” liable for the TFRP, the IRS is required to investigate and assess the TFRP against each person whose duty, status, and authority within a company or business requires them to collect, account for, and to pay over taxes held in trust for the benefit of the U.S. government and who willfully fails to perform any of these activities.

In the investigation, the IRS must prove that the responsible individual was willful — that is, aware of the outstanding taxes and either deliberately chose not to pay the taxes or recklessly disregarded an obvious risk that the taxes would not be paid. This requires the IRS to demonstrate that the responsible person had both knowledge of the tax delinquency and the authority to satisfy the delinquency at the same time as the liability is incurred.

The TFRP is a significant collection tool for the IRS in collecting delinquent payroll taxes as it allows the Government to reach responsible parties otherwise shielded from those tax liabilities including officers, shareholders, and employees of a corporation, partnership, or limited liability company.

IRS TFRP Investigations and Process Overview

The IRS must follow all required investigative and administrative procedures when making TFRP determinations on responsible persons. The IRS’s Collection function has sole responsibility for recommending an assertion of the TFRP. Revenue officers (IRS field collection personnel) are responsible for determining collection potential as well as investigating who they believe is responsible and willful for nonpayment.

The revenue officer (RO) also has the responsibility in determining whether responsible person(s) have the ability to pay the TFRP. The RO will both investigate the TFRP and pursue assessments against the business and its responsible person(s), and also set up collection agreements with all of the parties that are liable for the payroll taxes. In the end, the IRS will pursue assessments and collection against multiple parties — but it can ultimately collect the total amount only once.

Practice Tip: The RO will attempt to collect the balance owed expeditiously. The business or a responsible person may pay the entire amount, or everyone responsible may make payments of the amount. If the RO can readily collect from one party, they may pursue that one party for the total liability. Equitable payments from all parties is not a consideration for IRS collection because the IRS does not have to collect equally from all parties assessed. Responsible persons who bear a disproportionate payment of the outstanding balance need to pursue any equity arguments by other means (i.e., repayment from the other parties, etc.) outside of any IRS proceedings.

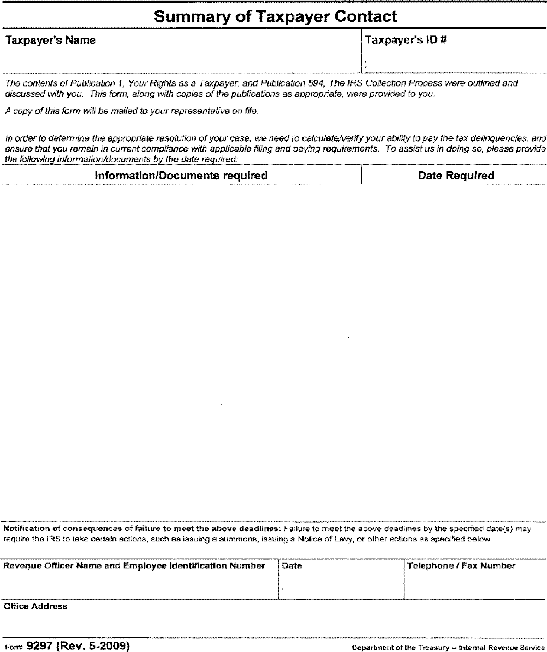

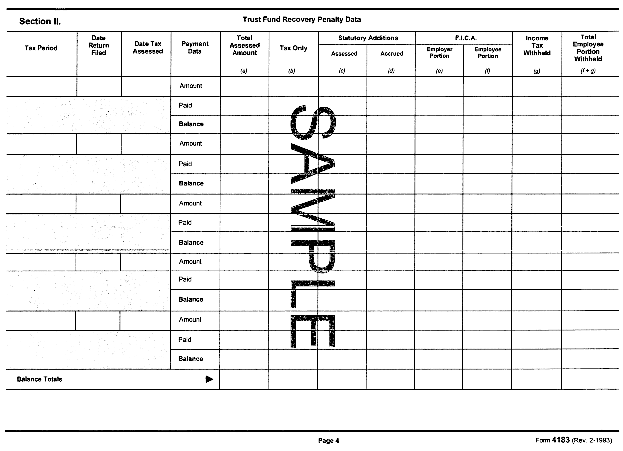

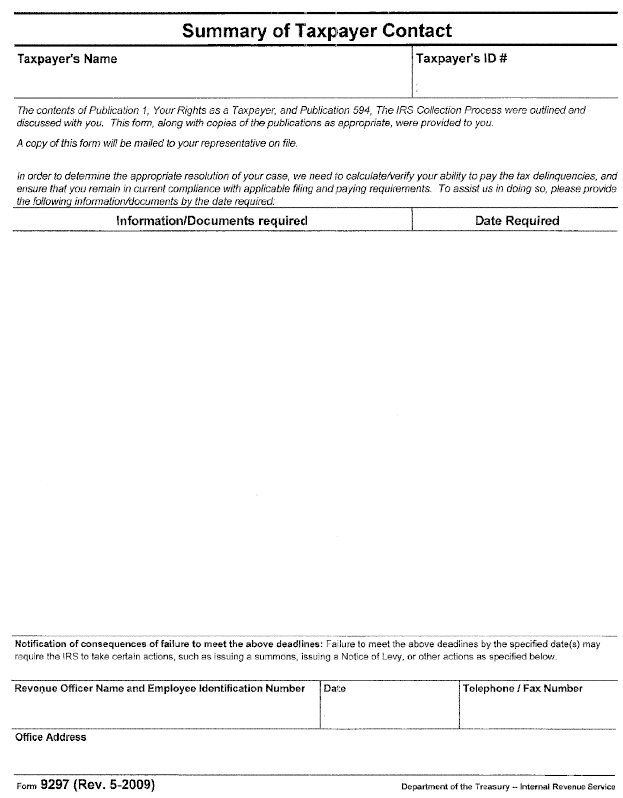

The TFRP investigation begins when the taxpayer contacts the employer regarding the outstanding balance owed. The IRS revenue officer can send Letter 725, Meeting Scheduled with Taxpayer, and a request for information and actions using Form 9297, Summary of Taxpayer Contact. [[IRM 5.1.10.3 (4-24-202510-12-2021)]]

At the initial meeting with the employer, the RO will attempt to conduct interviews of potentially responsible person(s). At the initial meeting, the RO will also:

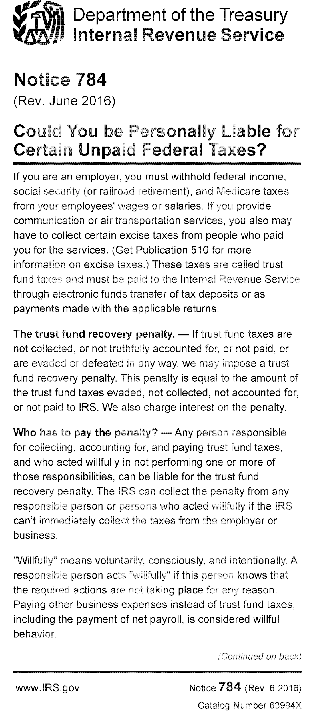

• Explain the TFRP, methods to avoid the TFRP (i.e., payment of taxes by business, payment of trust fund taxes) and provide the taxpayer their rights. The IRS will provide the taxpayer Publication 1, Your Rights As A Taxpayer, and Notice 784, Could You be Personally Liable for Certain Unpaid Federal Taxes?

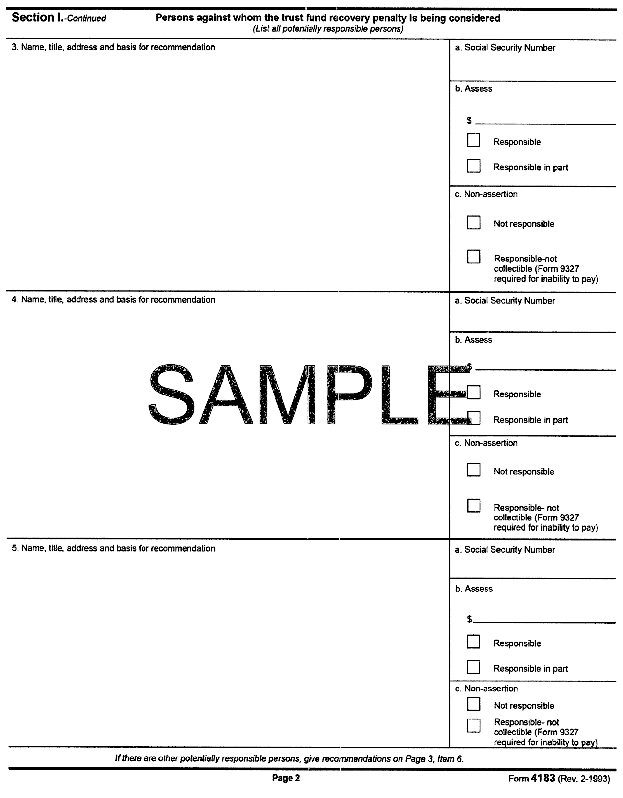

• Provide the taxpayer with a computation and explanation of the TFRP calculation. The IRS will provide the taxpayer page 4 of the Form 4183.

• Request records to support the assertion of the TFRP.

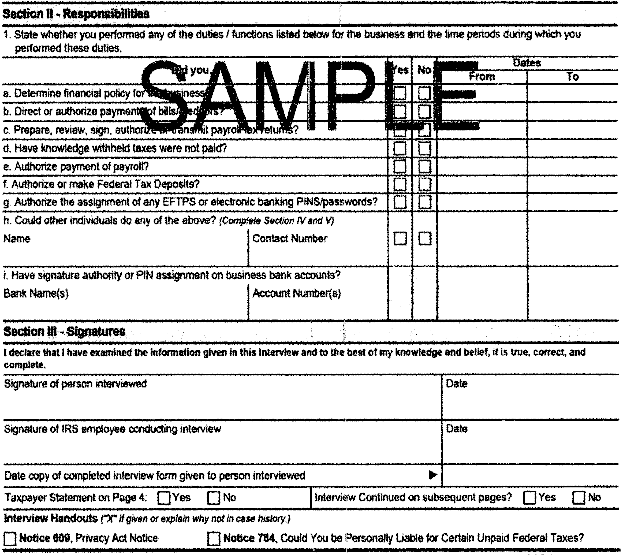

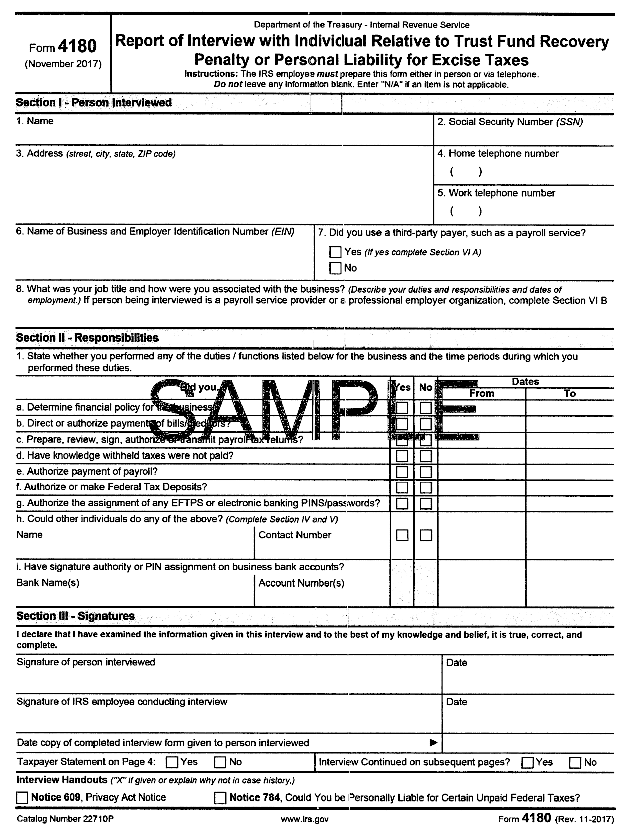

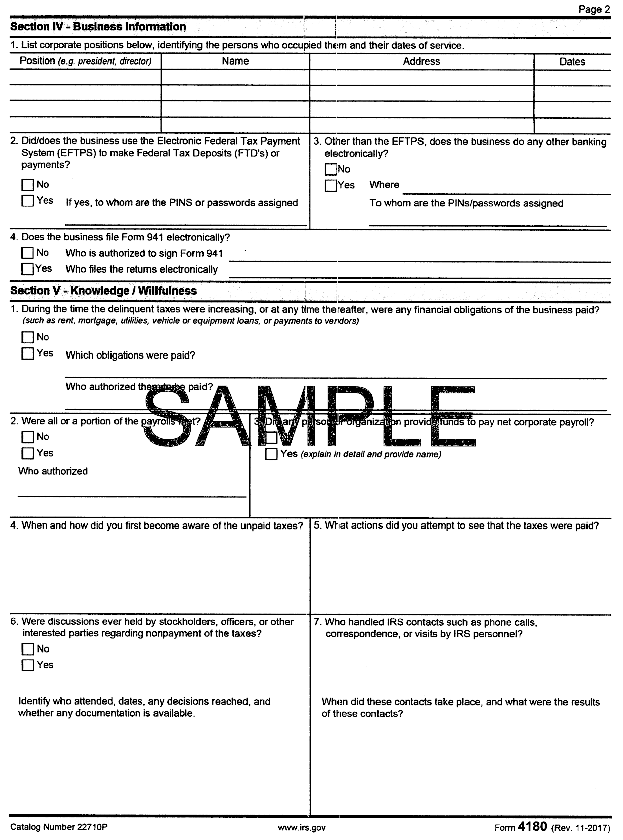

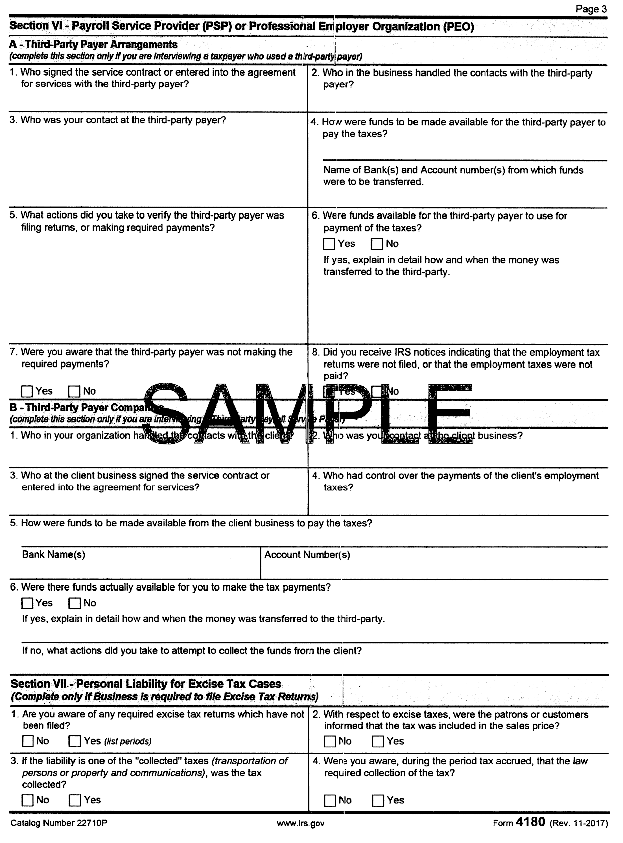

• Attempt to begin interviews of potentially responsible persons. The IRS will use Form 4180, Report of Interview with Individual Relative to Trust Fund Recovery Penalty or Personal Liability for Excise Taxes.

• Suspend any interview if the taxpayer or the responsible person(s) request representation.

If payment cannot be secured from the business/employer to satisfy the delinquent trust fund taxes, the IRS will continue to pursue assessment of the TFRP against all responsible persons. The TFRP investigation is centered around identifying and securing evidence that shows that each responsible person is responsible for collecting and paying the employment taxes and willfully fails to do so.

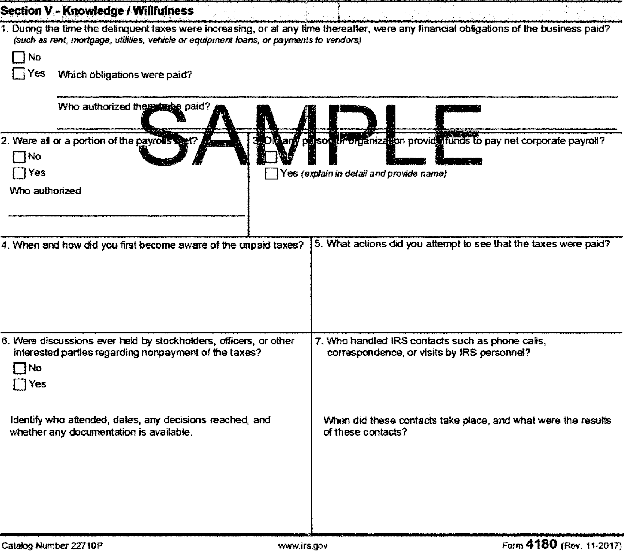

The IRS will use evidence collected from the business, an interview of the responsible person, and potential evidence gathered from third parties to determine responsibility and willfulness. The revenue officer will ask for specific documents using Form 9297, Summary of Taxpayer Contact, and request to interview responsible persons via Letter 3586, Meeting Scheduled with Individual for TFRP Interview. The IRS will notify the business/employer of their intent to contact a third party to gather information concerning responsible persons by issuing the business IRS Letter 3164-A, Third-Party Contact Letter. [IRM 5.7.4.2.5 (7-14-2023)] The interview of the responsible person will be documented on Form 4180, Report of Interview with Individual Relative to Trust Fund Recovery Penalty or Personal Liability for Excise Taxes. [IRM 5.7.4.2.4 (3-27-2023)]

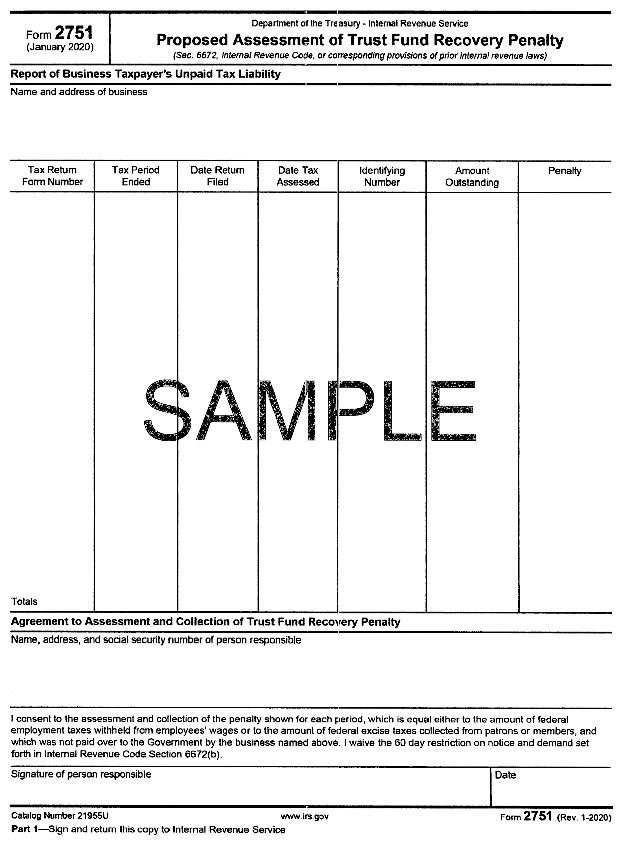

Practice Tip: In many cases, especially small business taxpayers, the responsible person is well known to both the IRS and the business. In these cases, the responsible person may want to consider agreeing to the TFRP. The responsible person can agree by signing Form 2751, Proposed Assessment of Trust Fund Recovery Penalty. [IRM 5.7.4.2.4 (3-27-2023)]

The RO will complete the Form 4180 in an interview with the potentially responsible person. At the end of the interview, the RO will ask the person to sign the form. The person will also be given a copy of the form for their records.

Practice Tip: Potentially responsible persons should always review the questions on Form 4180 prior to the TFRP interview and be prepared with their responses and defenses. See Form 4180 in ¶701.06. Also see ¶701.04 for factors and evidence used in determining responsibility and willfulness.

If the IRS proposes the TFRP against the responsible person, the responsible person will have the opportunity to appeal the decision with the IRS Independent Office of Appeals. If the appeal determination is adverse, the taxpayer can further contest the IRS Appeals findings by using Claim for Refund procedures. In cases where the taxpayer was not given the opportunity to contest the findings, they can use an Offer in compromise (OIC), Doubt as to liability, to contest the findings by presenting their facts to the IRS via the Form 656-L and the OIC proceedings.

Practice Tip: The OIC for Doubt as to Liability option is often mentioned as a potential solution to contesting the TFRP after assessment. However, in practice, it is rarely allowed. In 20243, the IRS only allowed four two OICs for Doubt as to Liability [IRS FOIA Response 2025-000324-05291]. In practice, it is best to contest the TFRP with the assigned revenue officer, their manager, and with IRS Independent Office of Appeals prior to the assessment.

See ¶701.03 for an in-depth discussion on the TFRP investigation process, responsible person determination, and appeals process.

Representation During the TFRP Interview

It is always recommended that employers and responsible persons have representation from a qualified tax professional during an employment tax investigation and TFRP interview of responsible persons. The IRS will usually demand that the taxpayer be present. However, the taxpayer has the right to representation and to have the licensed tax professional attend the interview. [IRM 5.7.4.2.3 (7-14-2023)]

Practice Tip: The IRS revenue officer will often insist that the taxpayer be present at the TFRP interview. However, an informed representative does not have to produce the taxpayer for the interview. [[IRC §7521(c)]] The IRS will ask detailed questions during the TFRP interview with the responsible person. The questions are outlined on IRS Form 4180 and ask about business operations, finances, payment priorities, and the person’s duties, authority, and participation. However, it is common for IRS revenue officers to go “off script” and ask other relevant questions and inquire about other potentially responsible persons. The representative should have a working understanding of the business and the responsible person’s actions regarding their participation in the business’s finances. If the representative cannot answer the RO’s questions, the representative should promptly get the answers back to the RO or risk that the RO will request to interview the taxpayer via an IRS administrative summons. [IRM 5.7.4.2.4 (3-27-2023)]

Limitation Period to Assess the TFRP

TFRP investigations and assessments need to be made before the assessment statute of limitations for the TFRP. IRC §6672 requires that the TFRP be assessed within three years. For payroll taxes, the three-year period starts with the date of the filing of the tax return or the due date of the return, whichever is later. For timely filed employment tax returns (i.e., Forms 941), the period of limitations is three years from the succeeding April 15th (the due date of the return) or the date the return is filed, whichever is later. [[IRM 5.17.7.2.7 (1-22-2024)]]The three-year period is held open for 90 days after the mailing of the preliminary penalty notice (Letter 1153). Also, if the person makes a timely protest of the proposed assessment in response to the preliminary penalty notice (IRS Letter 1153), the three-year period is held open until 30 days after IRS makes a final administrative determination with respect to the protest. [IRM 5.7.3.7.2 (7-24-2023)]

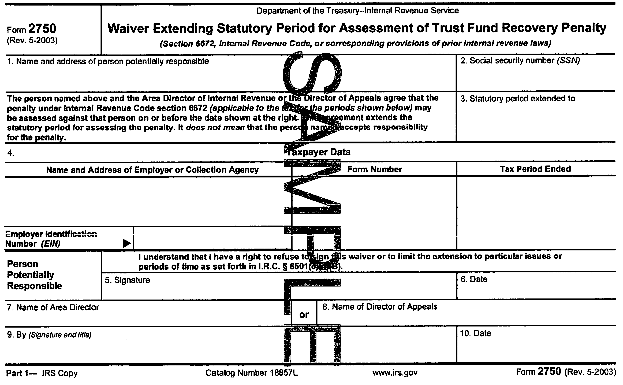

Practice Tip: The TFRP assessment statute provides a tight timeline for the revenue officer to make a proposed TFRP assessment. This tight timeline often prioritizes a quick TFRP investigation by the RO. Often in TFRP investigations, the RO will set quick turnaround times in order to not jeopardize the TFRP assessment. The RO can also request an extension to assess the TFRP. The three-year time limit may be extended by each responsible person(s) using Form 2750, Waiver Extending Statutory Period for Assessment of Trust Fund Recovery Penalty. Also, there is no limitation period to assess the TFRP if the employer has not filed an employment tax return.

LLCs and the TFRP

Generally, the IRS will have to conduct a TFRP investigation on limited liability company (LLC) entities, even if they are a single member, disregarded entity LLC for tax purposes (i.e., Schedule C, Form 1120, Form 1120S filer). [[IRM 5.1.21.6.5 at (3) (10-07-2020)]]The IRS will also investigate all other potentially responsible persons for purposes of assessment and collection of the TFRP. [IRM 5.7.3.4.1 (08-06-2015)]

¶701.02 Key Terms and Definitions

| Term | Definition |

| Collection Field function (CFf) | IRS local collection enforcement personnel who are responsible for investigating and collection on the most egregious tax debtors, including employers who are delinquent with their employment tax obligations. The CFf is responsible for investigating TFRP cases. |

| Federal Tax Deposit (FTD) Alert | An FTD Alert identifies, at an early stage (i.e., before the return is due), taxpayers who have fallen behind in their deposits. Revenue officers use FTD alerts to investigate employers who potentially are falling behind in payroll tax obligations in an attempt to proactively get them back into compliance. |

| “Pyramiding” taxpayer | A taxpayer, who is in-business, and not current with their FTDs and has two or more trust fund tax periods assigned to IRS Field Collection. Pyramiding taxpayers face immediate IRS enforcement actions if they do not resolve their delinquent tax issues. |

| “Repeater” taxpayer | A taxpayer who has more than one tax period with a taxpayer delinquent account (unpaid liability) or taxpayer delinquent investigation (unfiled return) that came into existence within the last two years. These taxpayers get priority enforcement from the IRS for FTD alerts and TFRP investigations to avoid becoming a “pyramiding” taxpayer. |

| Responsible person | Any person required to collect, account for, and pay over taxes held in trust who willfully fails to perform any of these activities. This person may be assessed the TFRP. |

| Responsible (for purposes of the trust fund recovery penalty) | A person who has the status, duty, and authority to ensure that the trust fund taxes are paid. |

| Revenue officer (RO) | IRS Field Collection personnel who investigate and recommend asserting the TFRP against responsible persons. |

| Trust fund taxes | In employment taxes, the trust fund portion is the amounts held in trust from the employee, including the Social Security, Medicare, and Income taxes withheld from an employee’s paycheck. It does not include FUTA taxes and the employer’s portion of the Social Security and Medicare taxes. |

| Trust fund recovery penalty (TFRP) | A penalty provided by IRC §6672 against any person required to collect, account for, and pay over taxes held in trust who willfully fails to perform any of these activities. The penalty is equal to the total amount of tax evaded, not collected, or not accounted for and paid over. |

| Willfulness (for purposes of the trust fund recovery penalty) | A person who is aware (or should have been aware) of the outstanding taxes and either intentionally disregarded the law or was plainly indifferent to its requirements. A failure to investigate or correct mismanagement after being notified that withholding taxes have not been paid satisfies the TFRP “willfulness” element. |

Trust Fund Recovery Penalty (TFRP) Investigation Process

A TFRP case begins when an employer owes back payroll taxes and does not satisfy their outstanding balances after a series of payment due notices from the IRS. See ¶301.11 for the IRS collection notice stream.

The TFRP investigation starts when the case is assigned to Field Collection.

Time Period to Assess the TFRP

The IRS only has a limited time to assess the TFRP. On a timely filed payroll tax return, the IRS has three years after the filing of the return to assess the TFRP. With respect to any taxable period within a calendar year, the period of limitations is three years from the succeeding April 15 (the due date of the return) or the date the return was filed, whichever is later. [IRM 5.17.7.2.7 (01-22-2024)]

A substitute for return (a return prepared and assessment made by the IRS when a taxpayer does not file a required tax return) is not considered the taxpayer’s filed return and does not start the assessment statute. If the return is fraudulent, the tax may be assessed at any time. [IRM 5.7.3.6 (11-12-2010)]

Once the TFRP is assessed, the TFRP may be collected by the IRS, by levy or by a proceeding in court, if the action has begun within ten years after the assessment was made. This is referred to as the collection statute of limitations. [[IRC §6502(a)]]

Responsible persons can individually extend the three-year statutory assessment period by executing Form 2750, Waiver Extending Statutory Period for Assessment of Trust Fund Recovery Penalty, with the IRS revenue officer. Form 2750 extends the assessment statute only for the person who signs the waiver. The IRS must identify and secure a waiver from all potentially responsible persons in order to properly protect the statute or risk not assessing the TFRP against all potentially responsible persons. [[IRM 5.7.3.7.1 (7-24-2023)]] Bankruptcy proceedings and filing an offer in compromise by the business entity generally does not automatically extend the time for the IRS to assess the TFRP against responsible persons. [IRM 5.7.3.7 (07-24-2023)]

Practice Tip: With limited IRS revenue officer resources, it is not uncommon for the IRS to start their investigation close to the end of the three-year TFRP assessment statute. As such, revenue officers often request a waiver on the TFRP assessment statute. Revenue officers have the option to do a “quick” assessment of the TFRP and normally do so if the TFRP assessment statute expires within 30 days and the taxpayer has not made a timely appeal. [[IRM 5.7.6.2.1 (4-10-2023)]] If the statute is imminent, the IRS will usually not consider quick or “prompt” assessments when the taxpayer is granted a payment plan or has an existing undefaulted payment plan, the assessment will be reported as not collectible, there are no assets or levy sources, or no enforcement action is planned. [[IRM 5.7.6.13 at (3) (3-5-2021)]] Taxpayers subject to the TFRP will need to weigh all factors before executing Form 2751 to extend the TFRP statute.

Steps in the TFRP Investigation

There are seven steps in the TFRP investigation process. The seven steps are outlined below:

Step #1: Unpaid, past-due employment taxes

A delinquent employment tax case is initiated when an employer fails to meet their employment tax obligations. This can occur in several ways, including after non-payment after a series of IRS notices requesting payment (the collection “notice stream”) or after an unresolved FTD alert inquiry by a revenue officer.

In the case of an employer who does not pay their employment taxes, the IRS will assign the case to Field Collection for investigation and resolution. Because TFRP assessments must be made within the three-year assessment statute (generally, starting to run on April 15 of the year in question, plus three years, for Forms 941 filed for a year), the IRS prioritizes employment tax investigation for enforcement.

The employer or a potentially responsible person can make voluntary payments to reduce the potential personal TFRP liability by making designated payments against the “trust fund portion only” amounts related to the employment tax liability. For example, if the employer has $100,000 of employment tax liability which includes $70,000 of trust fund taxes (the employee’s portion of Social Security/Medicare taxes and the federal income tax withheld), the employer can designate a voluntary payment of $70,000 (or a lesser amount if they cannot pay the total amount) to eliminate (or reduce) the trust fund portion. This designation of funds can be used to avoid the TFRP. [IRM 5.7.4.4 (7-14-2023)]

See ¶701.06 for a template letter to use to designate payments.

Practice Tip: If the employer obtains an installment agreement with the IRS on the outstanding employment tax balances, the employer cannot designate these monthly payments to go to the trust fund portion only. [[IRM 5.14.7.5 (08-05-2010)]] However, the employer and/or the responsible persons can make voluntary payments that are designated to the trust fund portion at any time.

Once the delinquent employment tax case is created, it is assigned to the Field Collection for enforcement.

Step #2: Assignment to Field Collection for TFRP Investigation

Delinquent payroll tax cases are a priority for IRS Collection. Cases with potential trust fund non-payment are quickly assigned to Collection Field function (CFf) for assignment. Prior to assignment, the case can be in a waiting for assignment status (called the “queue for a revenue officer” or Status 24) to a revenue officer. Once assigned to a revenue officer (RO), the case is quickly put into investigation to determine the collectibility of the employer and the potential for assessment of the TFRP.

Practice Tip: The amount of time the taxpayer can spend in the Field Collection “queue” can vary depending on the IRS field collection resources in the location of the taxpayer. However, the IRS will endeavor to promptly assign the delinquent employment tax case to an RO so that they can make the TFRP assessment before the three-year assessment period ends. Taxpayers, or their tax professionals, can inquire about their assignment, and get the field collection contact information, by contacting IRS Automated Collection or the IRS Practitioner Priority Service hotline. Once assigned to Field Collection, taxpayers will need to set up a collection alternative with the RO. They can make voluntary payments toward the balance owed. Once an RO is assigned, the RO can send Letter 725-B, Meeting Scheduled with Taxpayer, to the taxpayer to set up a time to visit the employer and their business. [[IRM 5.1.10.5 (4-24-202511-20-2017)]] If the taxpayer has a representative on file with the IRS, the RO will contact the representative to make an appointment. On July 23, 2023, the IRS announced a policy change that ended most unannounced visits to taxpayers by ROs. The policy change was enacted to reduce public confusion and enhance safety measures for its employees and taxpayers. [IR-2023-133 (July 24, 2023)]

Practice Tip: Unannounced RO visits are almost always planned duehad become increasingly uncommon due to the rise in impersonation scams. [IRM 5.1.10.3 at (11) (4-24-202510-12-2021)] In the event that an RO visits unexpectedly, taxpayers should always request to see the RO’s official credentials (called a “pocket commission”) to prove that he or she is an official IRS employee. Taxpayers who have a delinquent employment tax obligation that they cannot pay should anticipate IRS field collection action. It is recommended that taxpayers engage a qualified representative to assist in all TFRP investigations. To avoid IRS’s direct contact, the representative can file a Form 2848, Power of Attorney and Declaration of Representative, with the IRS before the investigation begins in order to direct the IRS contact the representative rather than the employer’s business.

At initial contact, whether by letter or in person, the RO will often provide the taxpayer a completed Form 9297, Summary of Taxpayer Contact, that lists the items needed and the deadline to provide the items to the RO, and Publication 1, Your Rights As A Taxpayer.

The Form 9297 will also include the enforcement actions that may result from the failure to comply. [IRM 5.1.10.3.2 at (89b) (4-24-202503-24-2020)] If an unexpected field visit is made by the RO and no contact was made, the RO will leave Form 2246, Field Contact Card, to advise the taxpayer how to contact the RO regarding an official IRS tax matter. The RO will request the taxpayer to respond within two business days. [IRM 5.1.10.3 at (6) (10-12-2021)]

The RO will also explain the collection process to the taxpayer and the taxpayer’s rights at the initial contact.

Practice Tip: It is always a good practice to obtain the RO manager’s name and contact information at the initial meeting in case of any situation in which a disagreement arises or the RO does not return your calls. The RO Collection manager is the first source of resolving any disagreement that you have with the RO.

Step #3: Collection enforcement and agreement on employer

The collection of the delinquent employment taxes starts at the initial contact. The RO will request that the employer make full payment at the initial contact. [IRM 5.7.4.2.1 at (1) (07-14-2023)] If the taxpayer cannot pay, the RO will also attempt to gather information about the business for purposes of determining if/how the taxpayer can pay. This information can include, but not be limited to:

- Financial statements, including information about income sources and assets.

- Number of employees and payroll information.

- Levy sources and banking information.

- Potentially responsible persons.

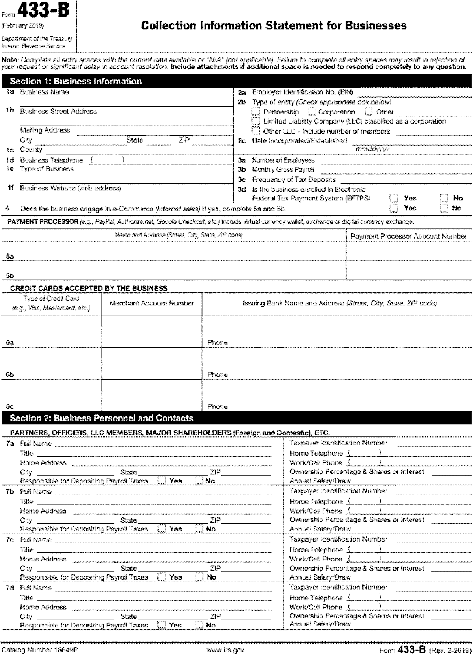

The RO will attempt to complete or request that the taxpayer/representative complete the comprehensive Form 433-B, Collection Information Statement for Businesses. (Reproduced below.)

The RO will start to evaluate the employer’s ability and willingness to pay. The RO will also look at whether the employer/business is current on the FTD so as to avoid future liabilities. The RO will demand that the business stay current on the employment tax obligations. Failure to do so or failure to cooperate with the investigation will likely result in immediate IRS enforcement actions.

One enforcement action is an IRS levy on the business’s bank accounts and major payers, including customers. If the delinquent account is not already subject to levy, the RO can issue Letter 1058, Final Notice of Intent to Levy, at the initial contact to speed up the enforced collection process through an IRS levy. The Letter 1058 initiates the 30-day period for the taxpayer to request a Collection Due Process (CDP) hearing. If the taxpayer does not request a CDP hearing or resolve the collection matter with the RO before the end of the 30-day period, the RO can proceed to levy against the employer/business at any time.

However, the taxpayer may not be afforded appeal rights and be subject to immediate levy if they meet the “disqualified employment tax levy” (DETL) terms under IRC §6330(h). A DETL is applicable if these three components are met:

- Levy served to collect employment taxes,

- The taxpayer or its predecessor previously requested a CDP levy hearing relating to employment taxes,

- The prior CDP hearing included unpaid employment taxes that arose within the two-year period prior to the beginning of the period for which the levy is served. [[IRM 5.11.1.5.2 (11-24-2021)]]

The two-year lookback period is measured from the beginning of the period for which the DETL is served. If the CDP levy hearing periods fall within the two-year period, the new period meets the criteria for a DETL. IRM 5.11.1.5.2 at (4) (11-24-2021) provides examples of how the lookback period is applied. When a DETL is served, the taxpayer will be given post-levy CDP rights.

Practice Tip: The RO does not use the DETL often in collection matters as a first collection action unless the taxpayer is not currently in compliance (i.e., continuing to not make FTDs and/or not file). Taxpayers are usually given a short period of time to correct their noncompliance and provide information about their ability to pay. Taxpayers who miss deadlines and/or cannot come into compliance may face a potential DETL if all of the DETL requirements are met.

As a general rule, if the business/employer cannot full pay — that is, pay the outstanding balance in full, is unwilling to cooperate, or enters into an IRS collection agreement (installment agreement, currently not collectible status, or an offer in compromise) — the IRS will proceed to assess the trust fund recovery penalty against all responsible persons. After assessment, the RO will pursue the assessed responsible person(s) for payment of the trust fund taxes. The RO will make the decision to pursue the TFRP within 120 days of assignment of the delinquent business account. [IRM 5.7.4.2 at (1) (07-14-2023)]

However, if the business/employer can enter into an “in-business trust fund express installment agreement” (IBTFIA), it may avoid the TFRP investigation. [[IRM 5.14.5.4 at (4) (10-14-2021)]] A business/employer qualifies for the IBTFIA if all of the following conditions exist:

- The business/employer owes $25,000 or less (assessed balance only, does not include accrued penalties and interest), [[IRM 5.14.5.4 at (1a) (10-14-2021)]]

- The outstanding balances only include the current or prior-year periods, and

- The taxpayer can pay the entire amount within 24 months. [IRM 5.14.5.4 at (1c) (10-14-2021)]

The taxpayer also must be up to date with filing and FTD payment requirements. If the taxpayer owes between $10,000 and $25,000, they must enroll in a direct debit installment agreement. [IRM 5.14.5.4 at (5) (10-14-2021)] Taxpayers can enter into these agreements online using the IRS’s Online Payment Agreement tool.

Practice Tip: Often the IRS does allow the taxpayer to use the IBTFIA option even if the tax periods are older (i.e., not the current or prior-year period). IRM 5.14.5.4 at (1c) (10-14-2021) infers that an IBTFIA may be granted if the taxpayer can pay within 24 months, or before the collection statute expiration date (CSED), whichever is shorter. The inference to the CSED indicates that the IRS will accept older periods into the IBTFIA. Taxpayers will need to contact IRS Collection directly to set up older period IBTFIAs. If completed timely, IBTFIAs also allow taxpayers to avoid a Notice of Federal Tax Lien (NFTL) filing. [[IRM 5.12.2.3.1 at (1) (10-14-2013)]] However, if the IRS files the NFTL prior to the taxpayer setting up the IBTFIA, the lien will not be automatically released until the balance has been paid or the taxpayer qualifies for other lien relief provisions.

Practice Tip: The RO can accept an IBTFIA. However, one of the first actions a RO may take on a delinquent payroll tax case is to file a NFTL. Taxpayers who want to avoid the NFTL should enter into an IBTFIA as soon as possible to avoid the lien filing.

In general, without full payment or an IBTFIA, all delinquent payroll taxes with balances over $25,000 will move forward to the TFRP investigation to pursue the responsible person(s) for collection of the trust fund taxes. Also, if the taxpayer has unfiled returns or a history of prior noncompliance, the RO may pursue the TFRP. [IRM 5.7.4.2.1 at (4) (07-14-2023)]

The IRS also may not pursue the TFRP if the taxpayer is out of business and cannot be identified or located. [IRM 5.7.4.2 at (3) (07-14-2023)]

Practice Tip: In cases where the business is transferring assets outside of the reach of the government, the IRS will likely pursue transferee liability to collect on the transferred assets. In these cases, the IRS may also pursue criminal sanctions against the taxpayer. These conditions always warrant the involvement of a qualified tax attorney.

Step #4: Responsible Person Investigation and Determination

The RO will attempt to identify potentially responsible persons and conduct TFRP interviews at the initial contact with the business. If the RO cannot interview potentially responsible persons at the initial contact, they will send Letter 3586, Meeting Scheduled with Individual for TFRP Interview.

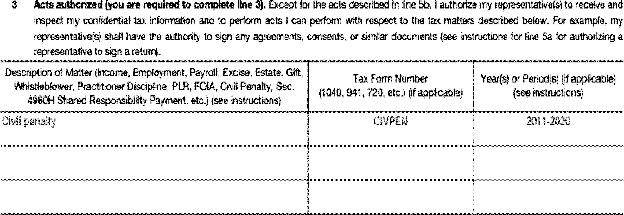

Practice Tip: Taxpayers should always seek representation in TFRP investigations by experienced, qualified tax professionals. However, tax professionals should be aware of potential conflicts of interest when representing multiple possible responsible persons. The individual taxpayer subject to the TFRP investigation must authorize the representative via IRS Form 2848, Power of Attorney and Declaration of Representative. The Form 2848 must include in section 3, the authorization for the TFRP or “civil penalty” investigation for the tax periods in question:

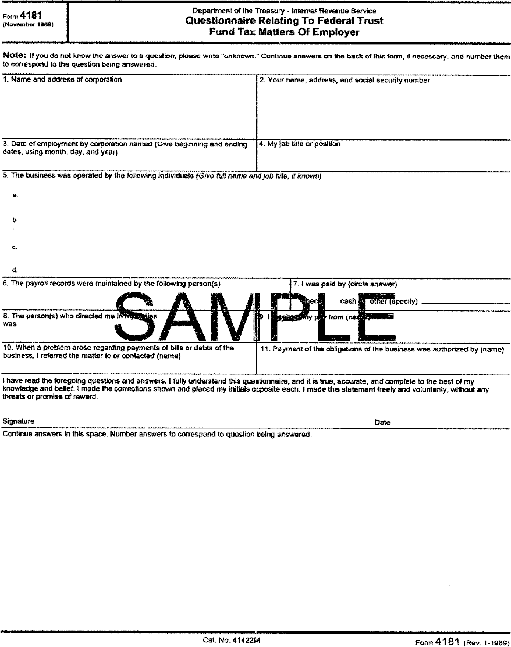

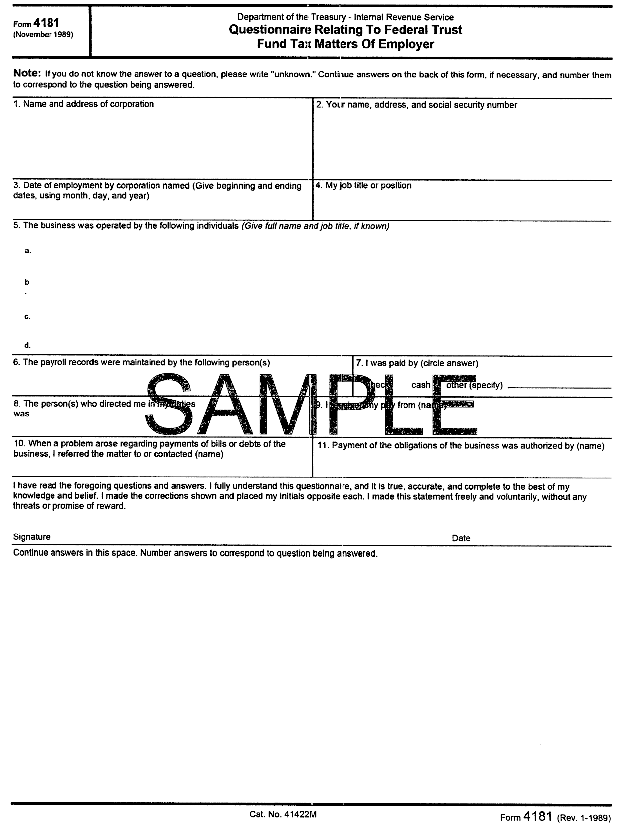

Once potentially responsible person(s) are identified for investigation, the RO will send Letter 3164-A, Third-Party Contact Letter, to all responsible and potentially responsible persons for the TFRP. [[IRM 11.3.40.5.2.9 at (1) (08-11-2017)]] The purpose of Letter 3164-A is to notify the taxpayer that they are subject to investigation, as a third-party, to the TFRP. [IRM 5.7.4.2.5 (07-14-2023)] The RO can send a Form 4181, Questionnaire Relating to Federal Trust Fund Tax Matters Of Employer, to a third-party or a potentially responsible person to obtain information related to the business, its operations, and other potentially responsible persons. If the third-party is subsequently implicated as potentially responsible and willful (i.e., a responsible person), the RO will proceed to interview the potentially responsible person for purposes of assessing the TFRP. [IRM 5.7.4.2.5 at (2) and (3) (07-14-2023)]

TFRP Interview

The RO will schedule separate TFRP interviews with each responsible person.

The RO will start the TFRP interview with the potentially responsible by providing such person with the following:

- A copy of their rights as a taxpayer (IRS Publication 1)

- An explanation of the TFRP

- A copy of the calculated TFRP amounts (IRS Form 4183, page 4)

- An explanation of how the TFRP is calculated

- Notice 784, Could You Be Personally Liable for Certain Unpaid Federal Taxes?, and Notice 609, Privacy Act Notice

- Advice on how to avoid the TFRP, including making payment of the payroll taxes in question

The person can stop the interview and request representation at any time. [IRM 5.7.4.2.3 at (1i) (07-14-2023). Generally, the IRS will provide 10-14 days to obtain representation.

After the RO has explained the TFRP process and taxpayer rights, the RO with proceed to the TFRP interview. This interview is also called the “Form 4180 Interview” referring to the IRS Form that guides the personal TFRP interview with the potentially responsible person. The purpose of the personal interview and the completion of the Form 4180 is to secure direct, detailed information regarding the person’s involvement in the business in order to determine if he or she meets the criteria for responsibility and willfulness. [IRM 5.7.4.2.4 at (2) (03-27-2023)]

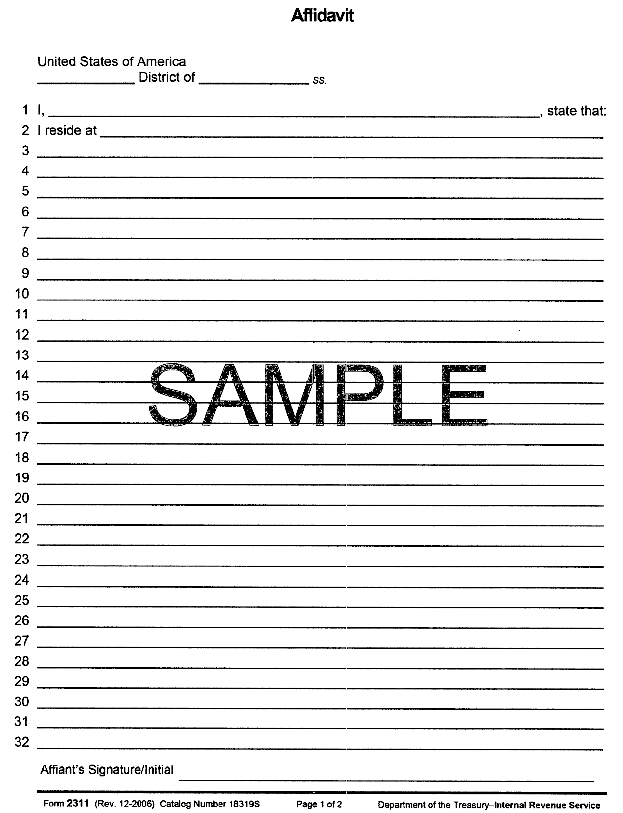

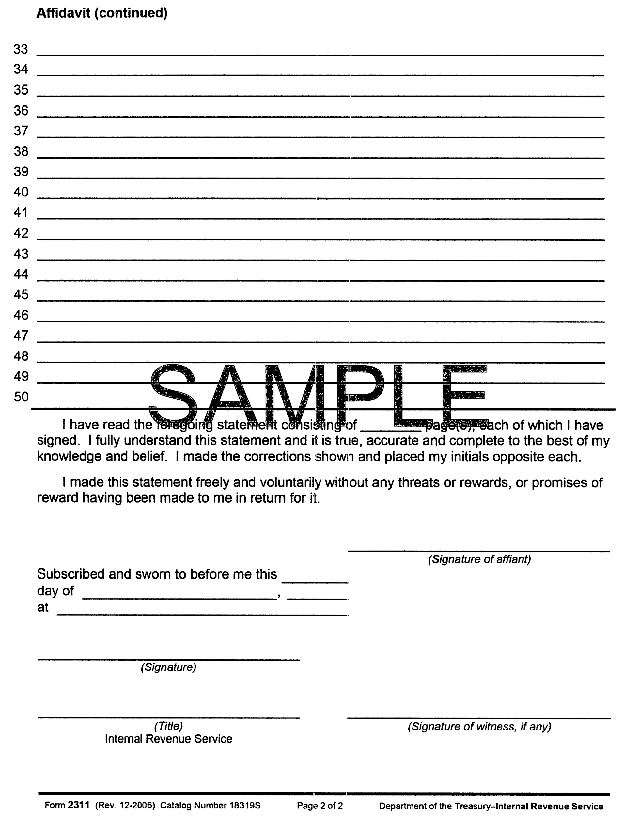

Practice Tip: Taxpayers and their representatives should always review Form 4180 prior to the TFRP interview. The taxpayer should be prepared to substantiate any claims that they are not responsible and/or willful with supporting documentation and arguments. The taxpayer can also take “testimony” from others to show that they were not responsible or willful. This testimony can be in the form of an affidavit. The IRS can also take affidavits. The IRS uses Form 2311, Affidavit, as a standard form for testimony.

The IRS requires the interview to be done in person or by phone. The RO will personally complete the form and not provide the form to the potentially responsible person to complete. The RO will use the Form 4180 as a guideline but will ask additional questions based on the person’s information provided.

Practice Tip: As a practical matter, many small businesses with one owner would concede to the TFRP assessment against the primary owner. If the person is obviously responsible, the RO would complete an abbreviated TFRP interview and request that the person sign Form 2751, Proposed Assessment of Trust Fund Recovery Penalty. By signing this form, the individual agrees to be assessed the TFRP. If the taxpayer does not agree that they are a responsible person, they should never sign the Form 2751. The signing of the Form 2751 waives the taxpayer’s right to appeal the determination. [IRM 5.7.4.2.4 at (7) and (10) (03-27-2023)]

Form 4180/TFRP Interview

The Form 4180/TFRP interview is broken into eight sections:

| # | Section | Purpose |

| 1 | Person Interviewed | Specifically identifies the person interviewed, their job title, and association with the business. The IRS will ask the person to be specific about their title, duties, and dates of employment. Also, allows for identification of a third-party payer, such as a payroll service. |

| 2 | Responsibilities | The RO will address the first requirement for determining whether the person had the status, duty, and authority as a responsible person. Those performing ministerial acts without exercising independent judgment will not be deemed responsible. In general, non-owner employees of the business entity, who act solely under the dominion and control of others, and who are not in a position to make independent decisions on behalf of the business entity, will not be asserted the trust fund recovery penalty. [IRS Policy Statement 5-14] The person will be asked about their specific duties/functions in the company, and the dates that they did these functions. These include their financial oversight of the business, payroll responsibilities, and access over bank accounts. The person will also be asked about others in the business who had responsible positions. If the IRS has financial records at the time of the interview, they will likely ask questions about the person’s involvement, including whether they had signature authority on bank accounts. |

| 3 | Signatures | The page 1 signature section allows for the RO to conduct a short TFRP interview. This is appropriate when there is only one responsible person, or the business is not complex. In many cases, the IRS will also ask the questions on page 2 in case the person does contest the TFRP assessment. |

| 4 | Business Information | The RO will ask the person about all responsible persons, their employment relationship, and the dates of their employment. The RO will also inquire about payroll filing and payment details, including authority and use of the Electronic Federal Tax Payment System (EFTPS) and Form 941 e-filing. |

| 5 | Knowledge/willfulness | The RO will investigate the second requirement: whether the person has willfully failed to collect or pay over trust fund taxes to the government. The RO will ask detailed questions about the person’s knowledge of the payroll delinquency and how company funds were directed and used during the delinquent period. The IRS will often have follow-up questions and request documents to substantiate the person’s assertions. |

| 6 | Payroll Service Provider arrangements/third-party payer companies (applicable if the taxpayer has a third-party payroll provider) | The RO will ask about Payroll Service Provider (PSP) or Professional Employer Organization (PEO) questions to assist the revenue officer in TFRP investigations when a PSP or PEO is involved. If the business has never used the services of a PSP or PEO, Section 6 will not require completion. |

| 7 | Personal liability for excise taxes Additional Information | Page 4 of the Form 4180 will allow the RO to document additional findings for which the other parts of the Form are incomplete and also allow the person to provide a statement. Taxpayers are also allowed to provide added statements later in the investigation. |

| 8 | Signatures | At the end of the interview, the RO will ask the person to sign the form. A copy is given to the taxpayer. |

Each person will have a separate Form 4180/TFRP interview.

See ¶701.06 for a complete copy of Form 4180. Use this form to prepare for the TFRP interview.

Document Requests

Before, during, and/or after the Form 4180/TFRP interview(s), the IRS will request documents to investigate who is responsible and when they were responsible for the delinquent payroll tax obligations. The documents requested depend on the type of entity and how the entity operated.

It is normal for the RO to request the following documents in the TFRP investigation:

| Document | Reason for request |

| Organizing documents Bank signature cards (all accounts) Bank statements Cancelled checks Loan applications Stock issuance documents Minute books Financial statements and budgets Payroll records Third party payroll contracts The IRS can also request any other documents that may be relevant to determine the roles and responsibilities of individuals within the business. | The business records may be reviewed to determine: • Duties (and changes to duties) of officers, directors, etc. • Appointments and resignations of officers, directors, etc. • Responsibilities of individuals to file and pay tax returns. • Issuance of stock to officers, directors, etc. • Assets transferred to officers, directors, etc. • Loans made to officers, directors, etc. • Unreported payroll and other taxes. • Diversion of funds. • Borrowing of funds not used to pay taxes. • Responsible parties within a Payroll Service Provider (PSP). • Responsible parties within a Professional Employer Organization (PEO). The bank records can be reviewed to determine: • Authority of persons to sign checks and deposit funds. • Authority of persons to obligate the business by borrowing. • Diversion of funds to officers, members, etc. • Deposits and withdrawals of alleged loans to business by officers, members, directors, etc. • Excessive salaries, expenses, etc. • Payment of other obligations. • Deposit records for monies received for sale of assets. • Deposit records of payments for stock, membership, or other ownership rights in the business. • Payments to third-party payers. • Any other relevant records. [IRM 5.7.4.2.7 at (11) (07-14-23)] |

The RO is instructed to obtain sufficient documentation in the file to support each recommendation for assertion for each specific period of the liability. [IRM 5.7.4.2.7 at (4) (07-14-2023)] The IRS will document the request on Form 9297, Summary of Taxpayer Contact.

The specific dates and evidence in the documents and interview will allow the RO to make an independent responsible person determination for each tax period (i.e., payroll quarter) based on the facts related to the quarter. Each quarter is an independent determination. Taxpayers can argue that they are not responsible and/or willful in each quarter.

In situations where the person will agree to the TFRP, the IRS will still ask for the supporting documents in case the taxpayer contests the TFRP in the future (i.e., in an appeal, offer in compromise, etc.). [IRM 5.7.4.2.7 at (5) (07-14-2023)]

If the business and/or responsible person(s) does not or cannot provide the information, the IRS will likely proceed to summon the information from a third-party. Before summons issuance, the IRS will provide the business a Letter 3164-A, Third-Party Contact Letter, to inform the business of the outside request for information. For financial account information, the RO will issue Form 6639, Financial Records Summons, to obtain documents (such as bank statements, loan applications, bank signature cards, and cancelled checks) from the financial institution. [IRM 5.7.4.2.7 at (3) (07-14-2023)]

When the investigation is complete, the RO will make their determination.

For more on the determination of responsible and willful, see ¶701.04.

Step #5: TFRP Determination and Appeal

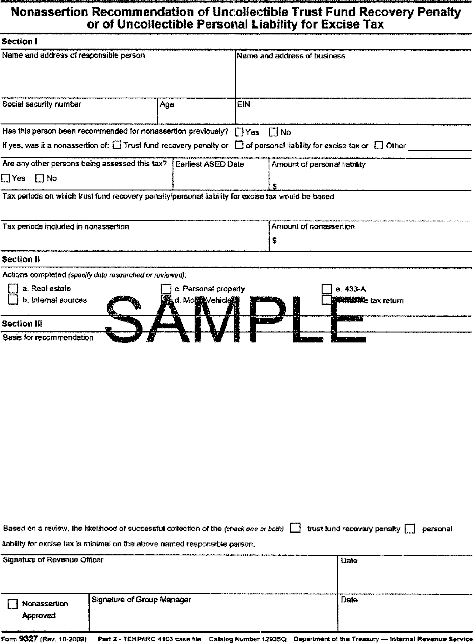

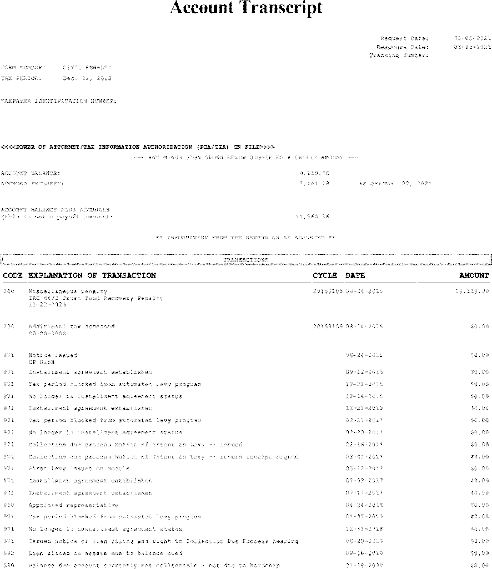

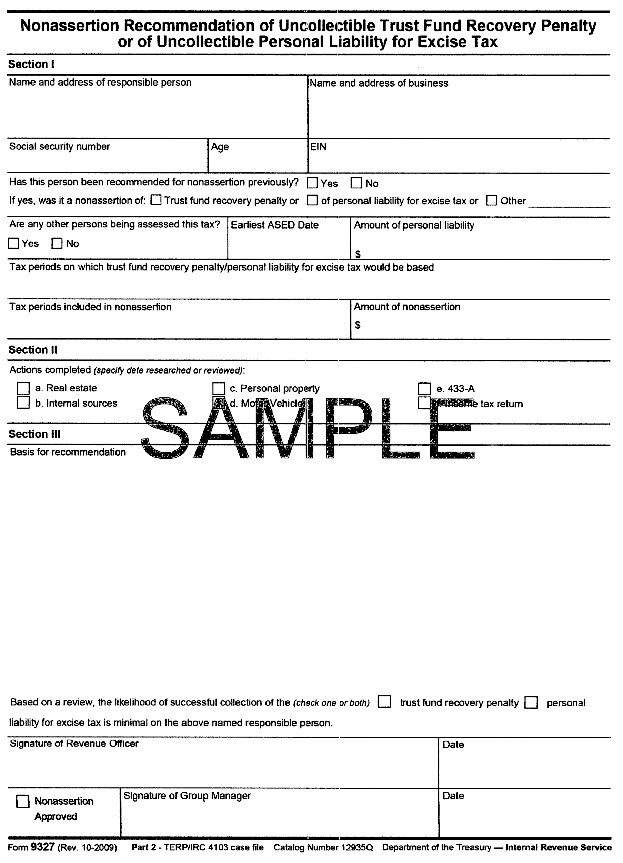

The RO will review all documents and the information from the interviews (Form 4180) to decide responsibility for each potentially responsible person. As part of determining whether to assess the TFRP, the RO will make a collectibility determination on each potentially responsible person. The RO will assess whether each person has the ability to pay with current and future income and assets. If the RO decides not to pursue the TFRP due to non-collectibility of the taxpayer, they will prepare Form 9327, Nonassertion Recommendation of Uncollectible Trust Fund Recovery Penalty or of Uncollectible Personal Liability for Excise Tax.

The RO will make this determination by obtaining a Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals, from the taxpayer along with an investigation into their ability to pay through assets or future monthly disposable income. See ¶309 for discussion of IRS Collection ability to pay determinations.

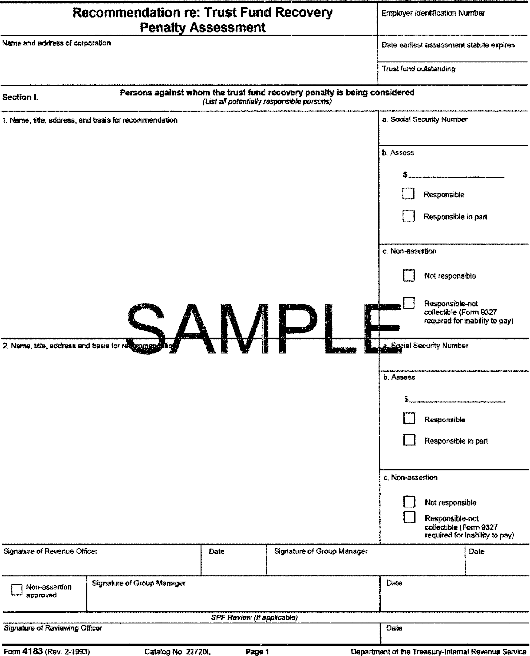

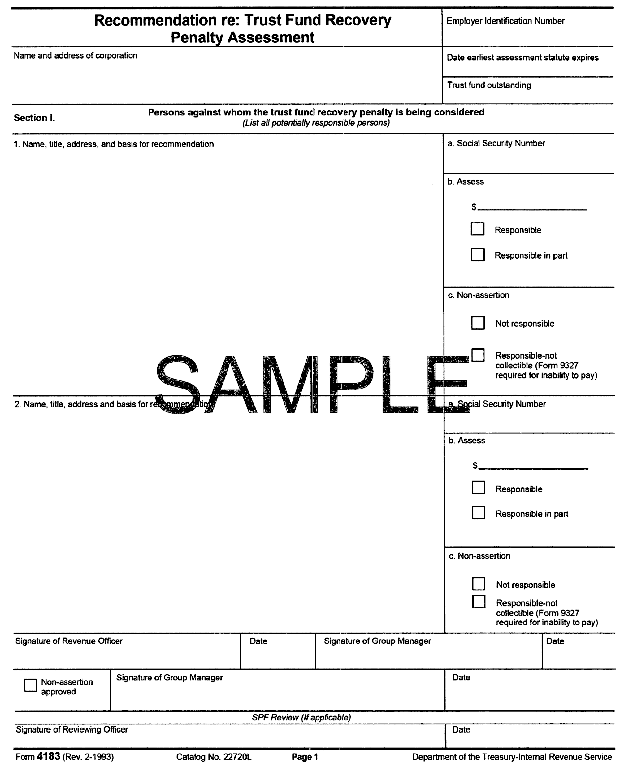

TFRP Assessment Recommendations

The RO will first contact the responsible person(s)/their representatives and provide their TFRP determination. The RO will follow up with a Form 4183, Recommendation re: Trust Fund Recovery Penalty Assessment, that outlines the RO’s determination and reasoning to assess the TFRP on the responsible person(s). The RO must address all person(s) considered for assertion of the TFRP on Form 4183 and must state the reasons for assertion or nonassertion for each person considered. This will include all individuals who were in a position that would warrant consideration. The RO must also indicate whether the individual is fully responsible for all periods or partially responsible for some periods. [IRM 5.7.4.5 at (3) (07-14-2023)]

e 7-13

The Form 4183 will include a statement of facts concerning responsibility and willfulness for each person listed, including those persons considered but not recommended for assertion. [IRM 5.7.4.5 at (4) (07-14-2023)]

The IRM provides an example of the narrative language that could be viewed on the Form 4183:

The Articles of Incorporation indicate Mr. A was president of the corporation from (date) to (date). He was responsible for filing the tax returns, making financial decisions for the business, and he exercised his signature authority on corporate checks at the (Bank name). He stated during the Form 4180 interview he was aware of the liability but allowed other creditors to be paid so he could remain in business. A review of a sampling of checks for the periods of the liability indicate Mr. A paid payroll as well as other creditors in preference to the government, such as vehicle, utility, and personal vacation expenses. He is both responsible and willful. A review of his financial statement shows equity in assets reflecting collection potential if the TFRP is assessed. [IRM 5.7.4.5 at (4) (07-14-2023)]

The RO will provide all of the evidence in their case file and forward the recommendations to their manager for approval. If the manager approves (both assertion and nonassertion recommendations), the RO will process the case file for assessment of the TFRP.

Practice Tip: If the taxpayers and their representatives disagree in whole or in part with the TFRP recommendation, they should always first provide their disagreement with the RO’s manager. The manager can take a fresh look at the evidence and provide their assessment before proceeding to IRS appeals.

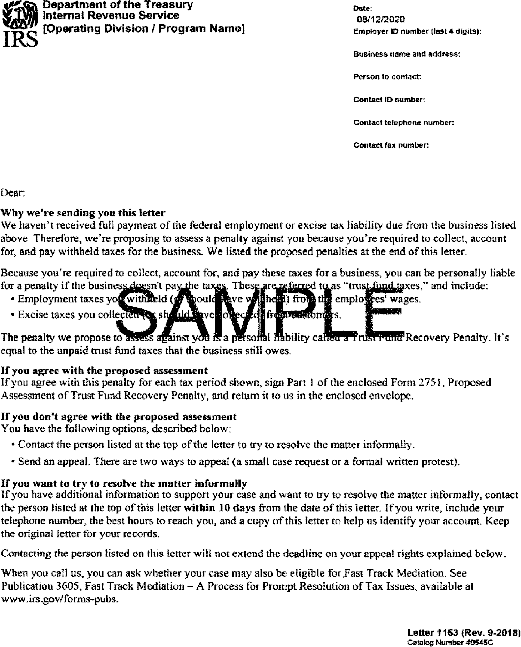

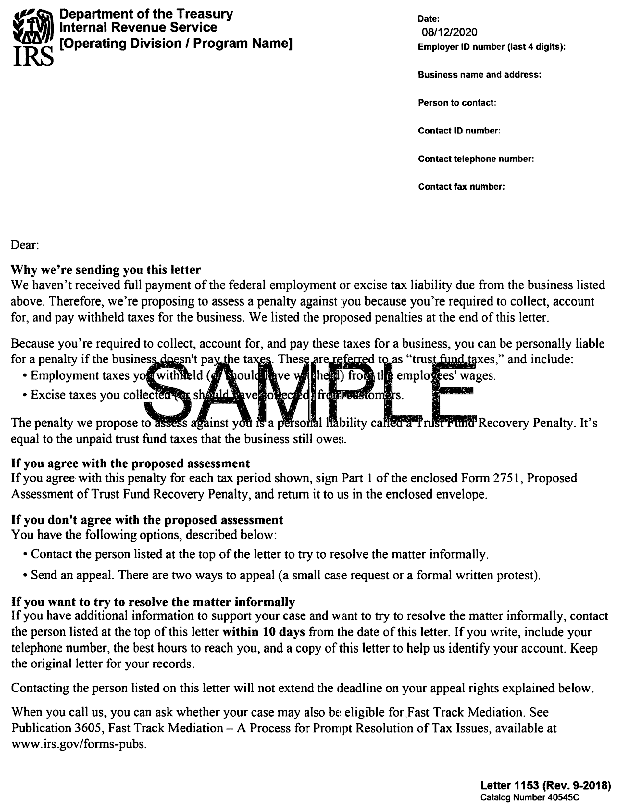

If the IRS proceeds to recommend assessment of the TFRP, each responsible person will receive Letter 1153, Notification of Proposed TFRP Assessment (60-day letter). The IRS will issue this letter within 20 days of the Form 4183 approval by the RO’s manager. The Letter 1153 will be hand delivered or sent by certified mail to the responsible person.

Form 2751, Proposed Assessment of Trust Fund Recovery Penalty, will also be included with the Letter 1153 that allows the person to agree to the TFRP. The Form 2751 will also include the computation of the TFRP. At that point, the responsible person will have future refunds frozen on their account and will remain until the balance is settled or the person is determined not to be responsible for the TFRP. [IRM 5.7.4.7 at (2) (03-27-2023)]

Appealing the TFRP Determination

The Letter 1153 will provide the taxpayer with the information on appealing the TFRP determination. The Letter 1153 also provides the taxpayer 60 days from the date of the letter to protest the determination with the IRS Independent Office of Appeals. [IRM 5.7.4.7 at (3) (03-27-2023)] The Letter 1153 date will satisfy the assessment statute requirements for the TFRP if the letter is mailed or delivered to the responsible person before the assessment statute expiration date. If the Letter 1153 was properly issued, the assessment statute date will not expire before the later of:

- The date that is 90 days after the date on which the 60-day notice was mailed (or delivered in person)

- 30 days after Appeals’ “final administrative determination” if the potentially responsible person files a timely protest (mailed, or faxed, if applicable, on or before the 60th day after the proper mailing or personal delivery of Letter 1153(DO))

[IRM 5.7.3.7.2 at (1) (7-24-2023)]

To protest the TFRP determination, the responsible person may request Fast Track Mediation (FTM) (see IRS Publication 3605). The program is designed to expedite case resolution. The IRS reports that it takes 30-40 days to complete, as opposed to several months with IRS appeals. [[IRM 5.7.6.4 at (3) (4-10-2023)]]

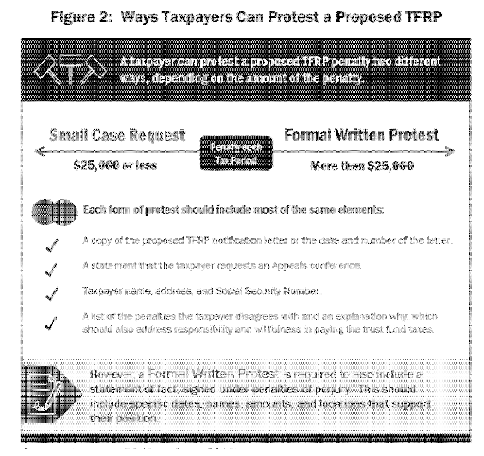

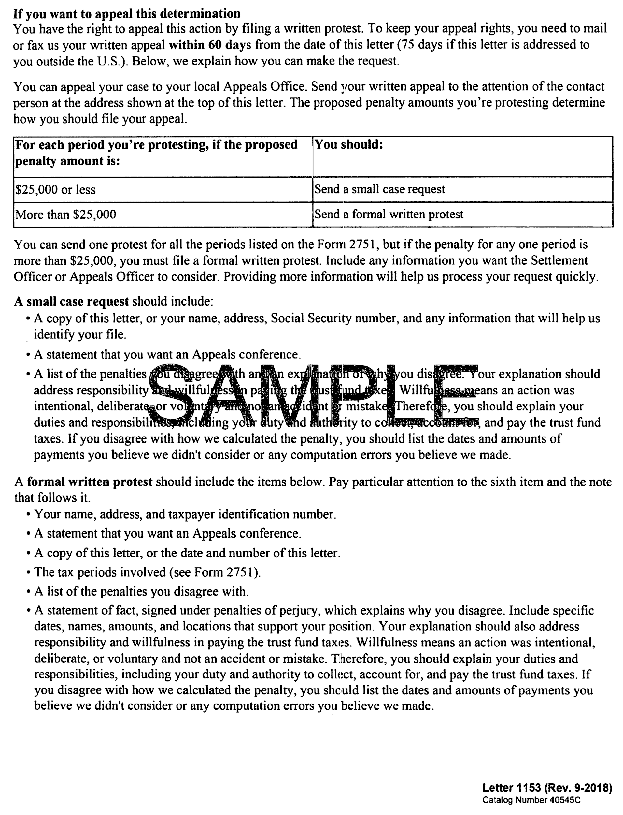

Practice Tip: Once the Letter 1153 is issued, the taxpayer will have 60 days to appeal the TFRP determination. Requesting FTM does not extend this time period. Few taxpayers use FTM as a means of resolving TFRP cases because the mediators are IRS appeals’ employees and the revenue officer must also agree to mediation. As a practical measure, most TFRP disagreements are resolved in IRS appeals. To request an appeal, the taxpayer/representative will need to file a protest with the RO. The Letter 1153 provides the address to send the protest. The taxpayer can send the protest to the IRS by mail and/or fax. The appeal must be received on or before 60 days from the date of the letter. [[IRM 8.25.2.3.2.2 at (1) and (2) (09-05-2018)]] The 60-day period cannot be extended by the IRS. The taxpayer has two ways to petition, depending on the amount owed.

[[TIGTA Report 2020-10-042, Existing Controls Did Not Prevent Unauthorized Disclosures and Case Documentation Issues in Appeals Trust Fund Recovery Penalty Cases (Aug. 12, 2020)]]

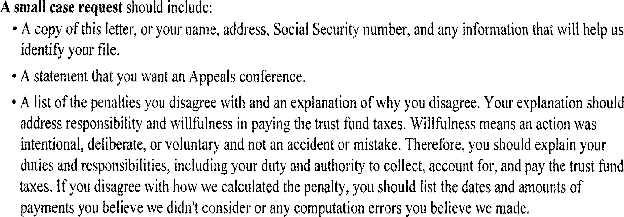

If the proposed tax, penalties, and interest for each period is $25,000 or less, the taxpayer can file a “small case request.” The Letter 1153 describes the format and what to include in the protest:

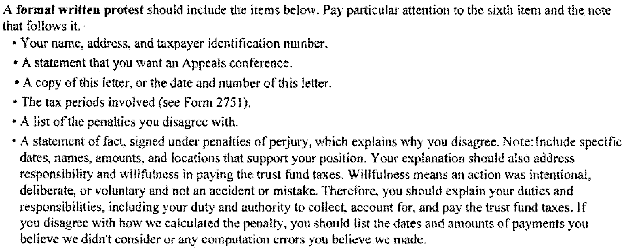

If more than one period is involved and any tax period exceeds the $25,000 threshold, a Formal Written Protest for all periods is required to be filed. The Letter 1153 describes the format and what to include in the Formal Written Protest:

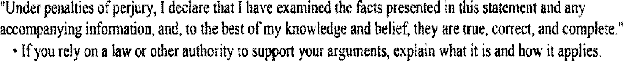

In the protest, the taxpayer must attest to the accuracy by including the following statement:

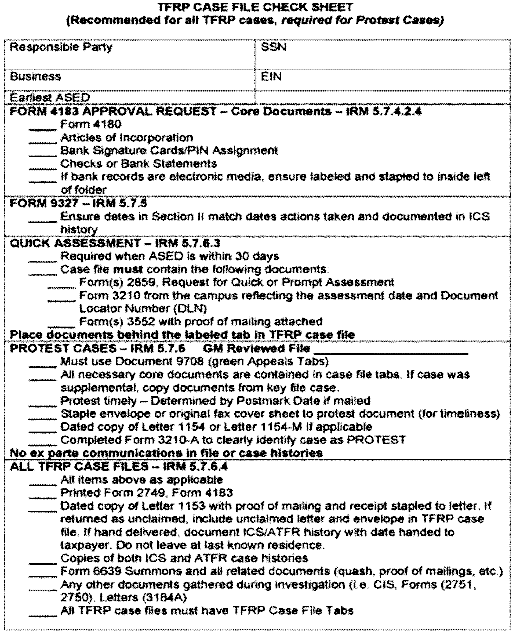

Once the RO receives the timely protest, they will forward the entire case file to the IRS Independent Office of Appeals. The RO will include in the case file all of the items listed on their “TFRP Case File Check Sheet”:

When the case is forwarded to the IRS Independent Office of Appeals, the revenue officer sends the taxpayer a Letter 1154, Notice of Protest of Trust Fund Recovery Penalty to be Forwarded to Appeals.

Appeals Hearing

Once IRS Appeals receives the protest, they will contact the taxpayer within 45 days via Letter 5157, Nondocketed Acknowledgement & Conference. The letter will also include IRS Publications 4167, Appeals, and 4227, Overview of the Appeals Process, explaining the appeals rights and process. [[IRM 8.25.2.2 (09-05-2018)]]

The IRS Appeals Officer (AO, or sometimes referred to as the “appeals technical employee” or “ATE”) will first verify the accuracy of the technical and procedural requirements (timeliness of protest, validity of protest format, tax periods, TFRP amounts, statute dates, Letter 1153 procedural requirements, and complete case file contents). If the protest is defective, the AO will contact the taxpayer/representative to perfect the protest within 30 days. [[IRM 8.25.2.3.3.7 (12-12-2012)]]

The AO will review the evidence in the case file and request additional information, if needed, that will help in their decision. The AO will also analyze relevant case law and make a legal interpretation on whether the person is responsible and willful. Most interpretations involve TFRP determinations from Tax Court decisions (from CDP cases) and from District Court/Court of Claims decisions (from Claim for Refund cases). [[IRM 8.25.2.4.3 (12-12-2012)]]

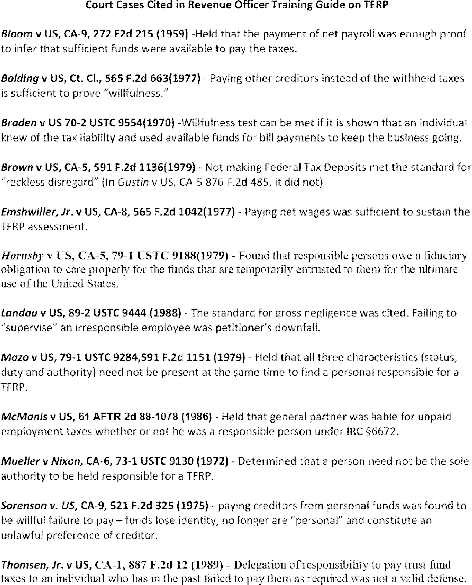

IRS ROs and AOs often cite supporting cases in arguing responsibility and willfulness in TFRP cases. The RO/AO most often use these cases to support their position: [IRS Revenue Officer Training on TFRP]

Taxpayers/representatives should analyze relevant cases to support their argument when contesting the TFRP determination.

In the appeals conference, the AO is advised to remain neutral and make a ruling based on all of the facts in the case file and all of the taxpayer’s statements during the conference. The AO will weigh the testimony based on the taxpayer’s history, consistency, and credibility, and assess whether evidence supports their testimony. [[IRM 8.25.2.5 (07-23-2020)]]

After consideration of the facts and law, the AO will make a determination. If the AO agrees with the taxpayer, the AO will notify the taxpayer/representative and issue a closing letter. In an adverse determination, the taxpayer will be explained their judicial appeal rights.

In many cases, the determination will not be clear, and the IRS AO may seek a settlement. Appeals has three settlements related to TFRP determinations:

- Factual settlements: in these cases, the interpretation of the facts is not clear. For example, application of payments or changes in the person’s duties or the organization over the TFRP tax period bring into question the validity of the TFRP. In these cases, a settlement may be appropriate. [[IRM 8.25.2.6.1 (12-12-2012)]]

- Allocation settlements: the AO may settle a TFRP case by allocating the TFRP among the responsible persons. In these cases, the AO would secure payment of the liability and also secure a Form 2751-AD, Trust Fund Recovery Penalty – Offer of Agreement to Assessment and Collection , from all persons. The Form 2751-AD or a similar closing agreement will finalize the matter and not allow the persons to file a future appeal through a Claim for Refund. [[IRM 8.25.2.6.2 (12-12-2012)]]

- Hazards of litigation settlements: the AO can settle a case based on substantial uncertainty about the outcome of a case if the taxpayer would petition the court. In these cases, the AO will weigh the evidence and law and seek a settlement that is acceptable to all parties. [[IRM 8.25.2.6.3 (12-12-2012)]] In these cases, the AO will seek a closing agreement (Form 866 with custom agreement language) from the taxpayer to finalize the matter and limit the taxpayer from future court appeals. [IRM 8.25.2.6.4 (09-05-2018)]

If there is TFRP assessment at the end of the appeals process, the IRS will proceed to assess the amount. After assessment and nonpayment, the taxpayer’s case will be forwarded to IRS Collection for an ability to pay evaluation and potential collection alternative solutions (installment agreement, not collectible status, or an offer in compromise). Further post-assessment appeal is available if new facts emerge or if the taxpayer believes they will obtain a better outcome in the courts by following Claim for Refund procedures.

Practice Tip: Adverse determinations from TFRP appeals cases that originate from a Collection Due Process (CDP) hearing can be petitioned to the U.S. Tax Court. All other cases that do not originate from CDP must follow the Claim for Refund procedures.

Step #6: Assessment and Collection of TFRP

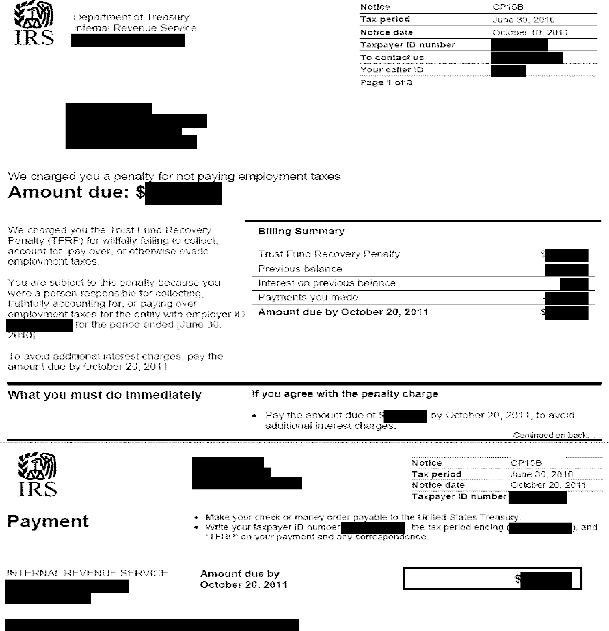

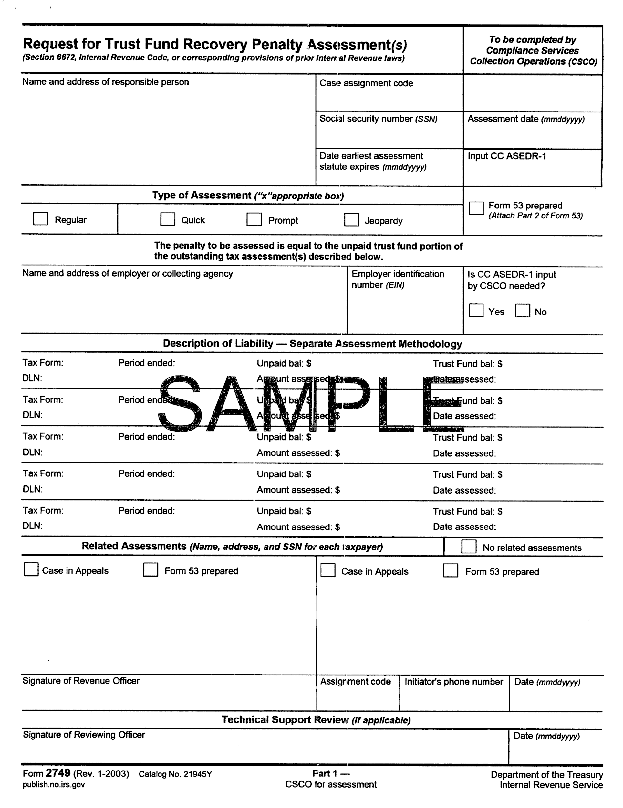

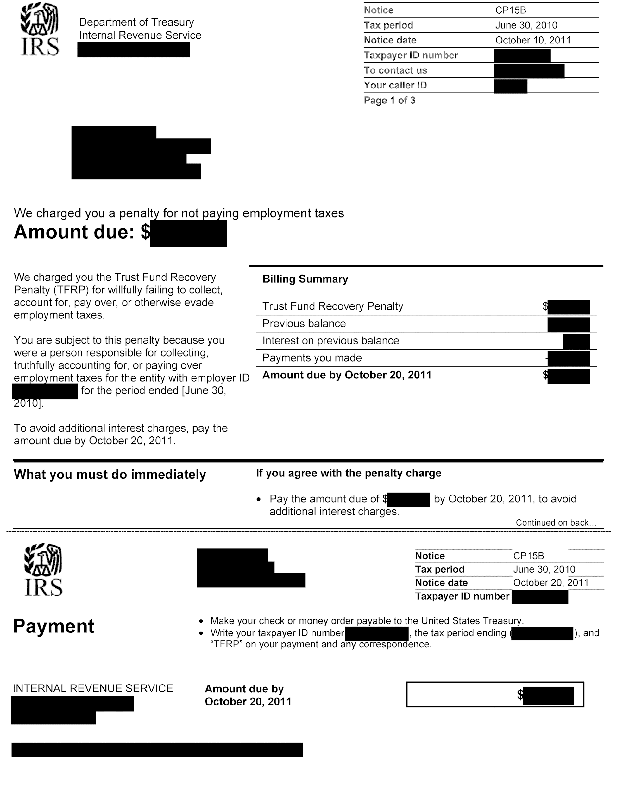

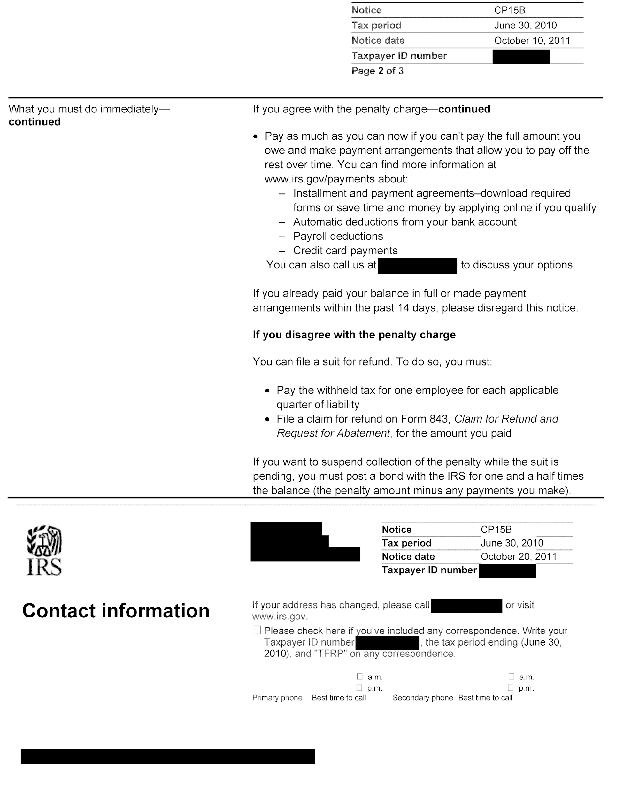

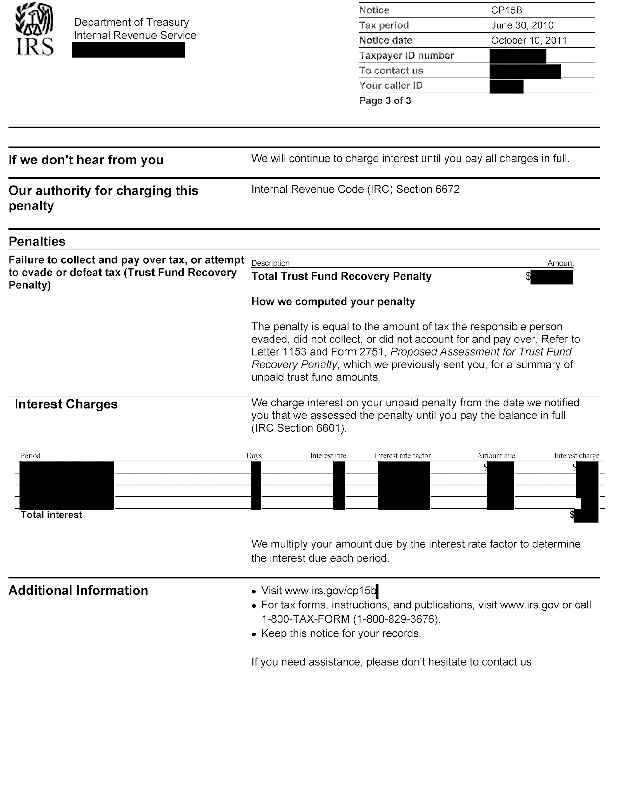

At the end of the final TFRP determination, the RO/AO will prepare Form 2749, Request for Trust Fund Recovery Penalty Assessment(s), to assess the TFRP. The IRS will send IRS notice CP15B to notify the taxpayer that the TFRP has been assessed. After assessment, the IRS has ten years to collect the TFRP. [IRM 5.17.7.2.10 (08-01-2010)vv and [IRC §6502(a)]]

TFRP assessed taxpayers are generally not afforded discharge under the Bankruptcy Code. See IRM 5.17.7.2.11 (11-02-2007) for a discussion of bankruptcy and the TFRP. Taxpayers should consult legal counsel when contemplating bankruptcy as a means to resolve any tax debt issues, including TFRP assessments.